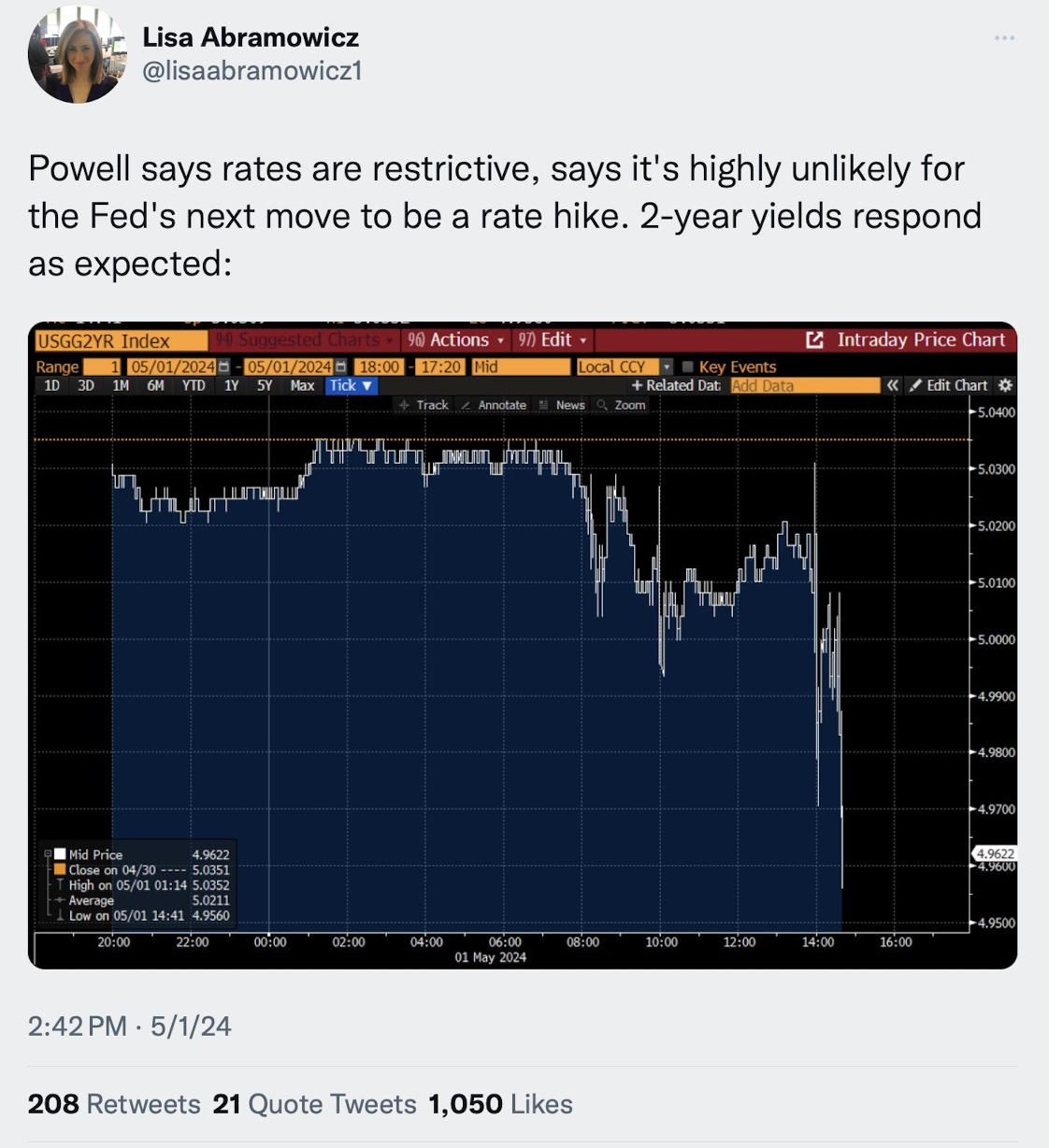

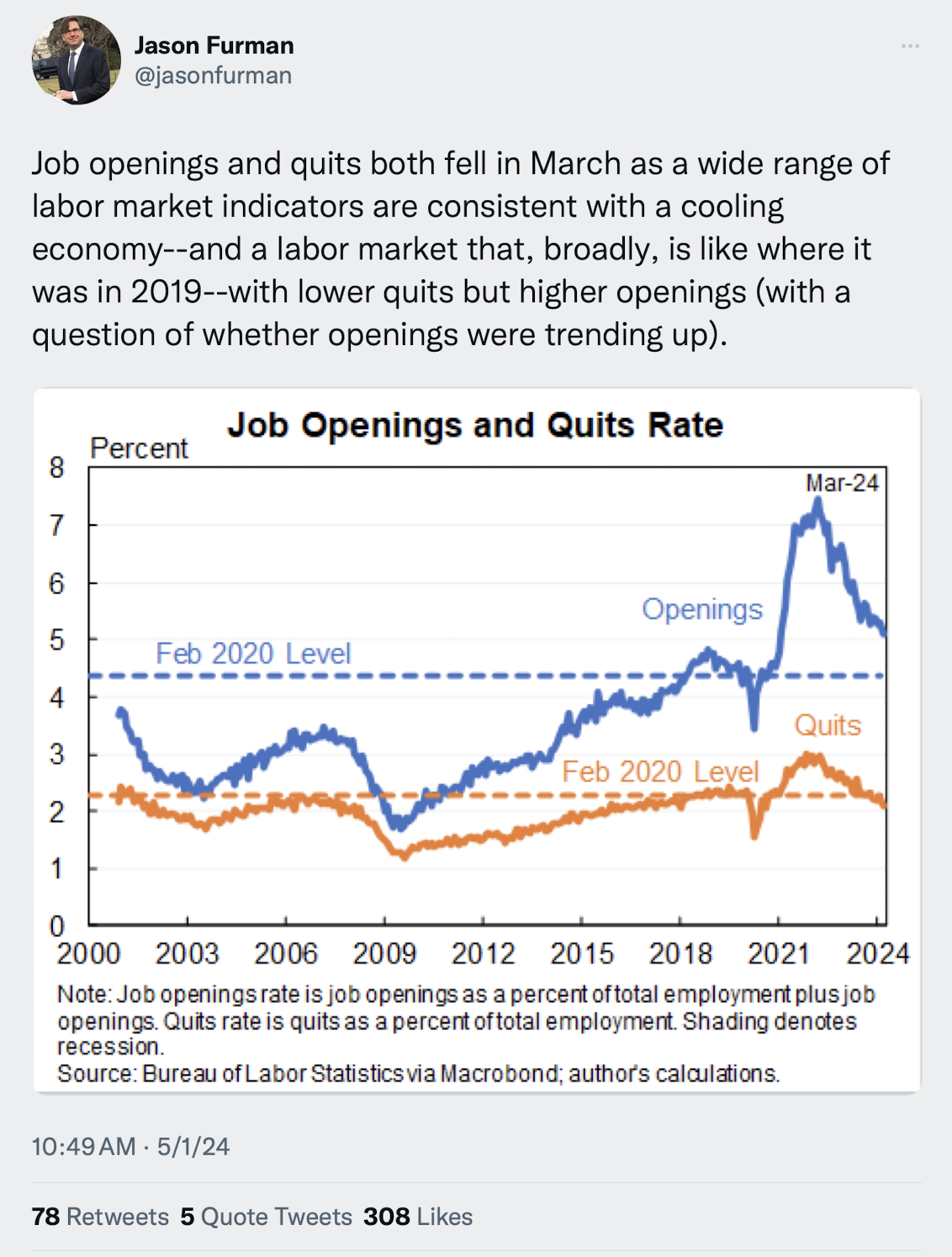

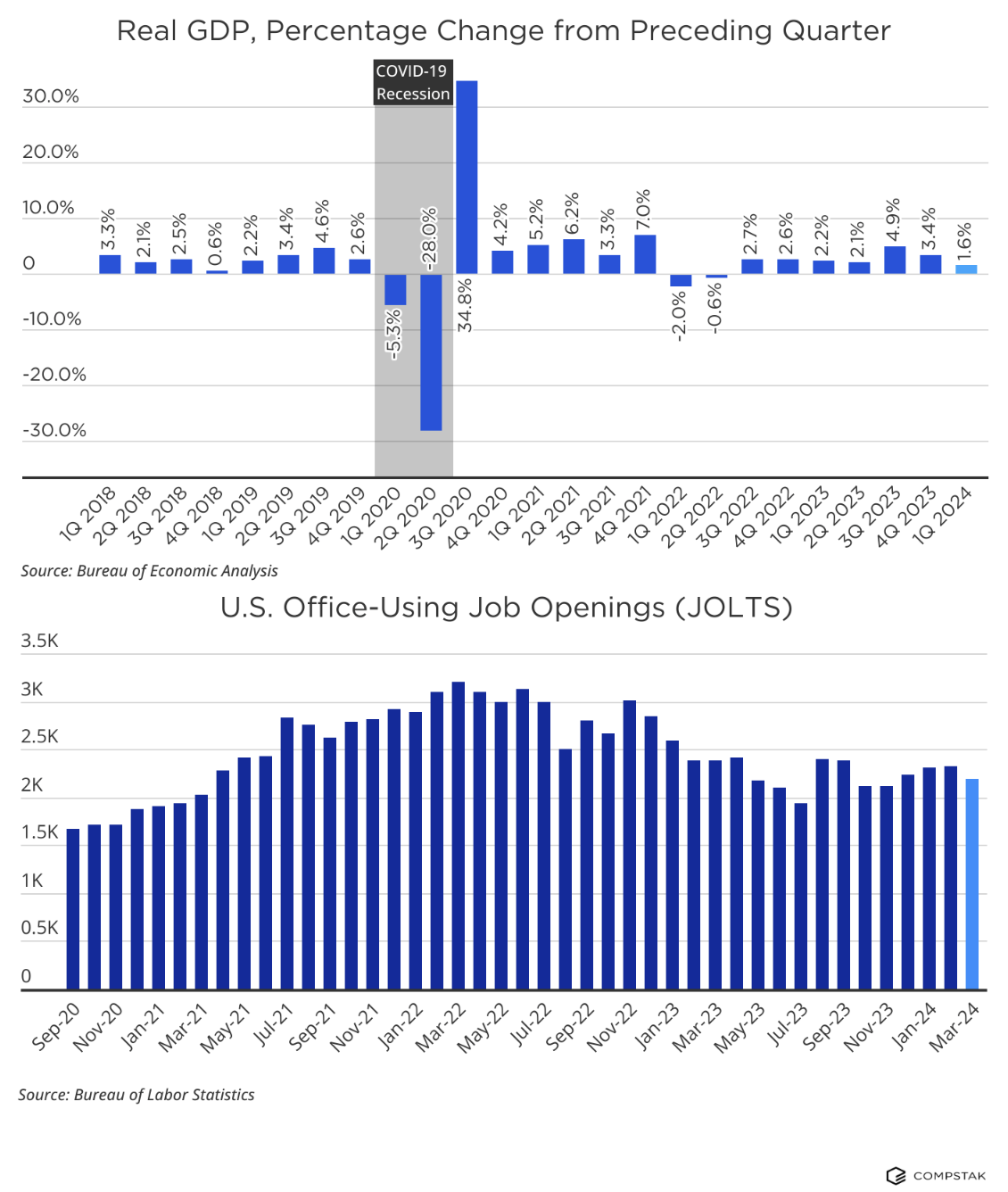

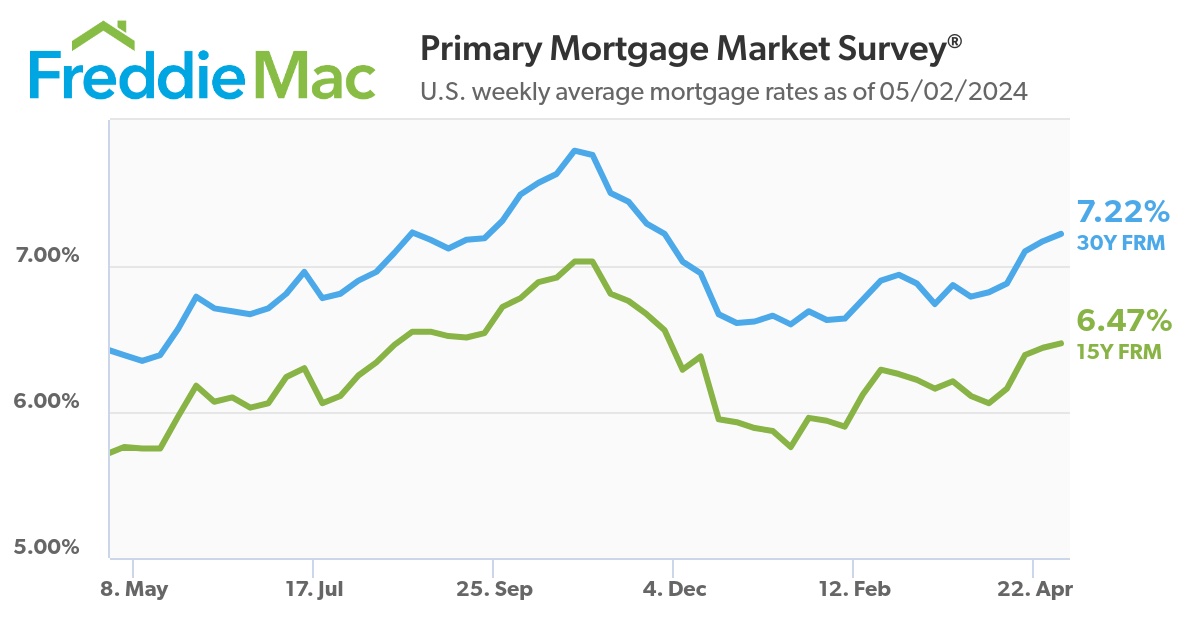

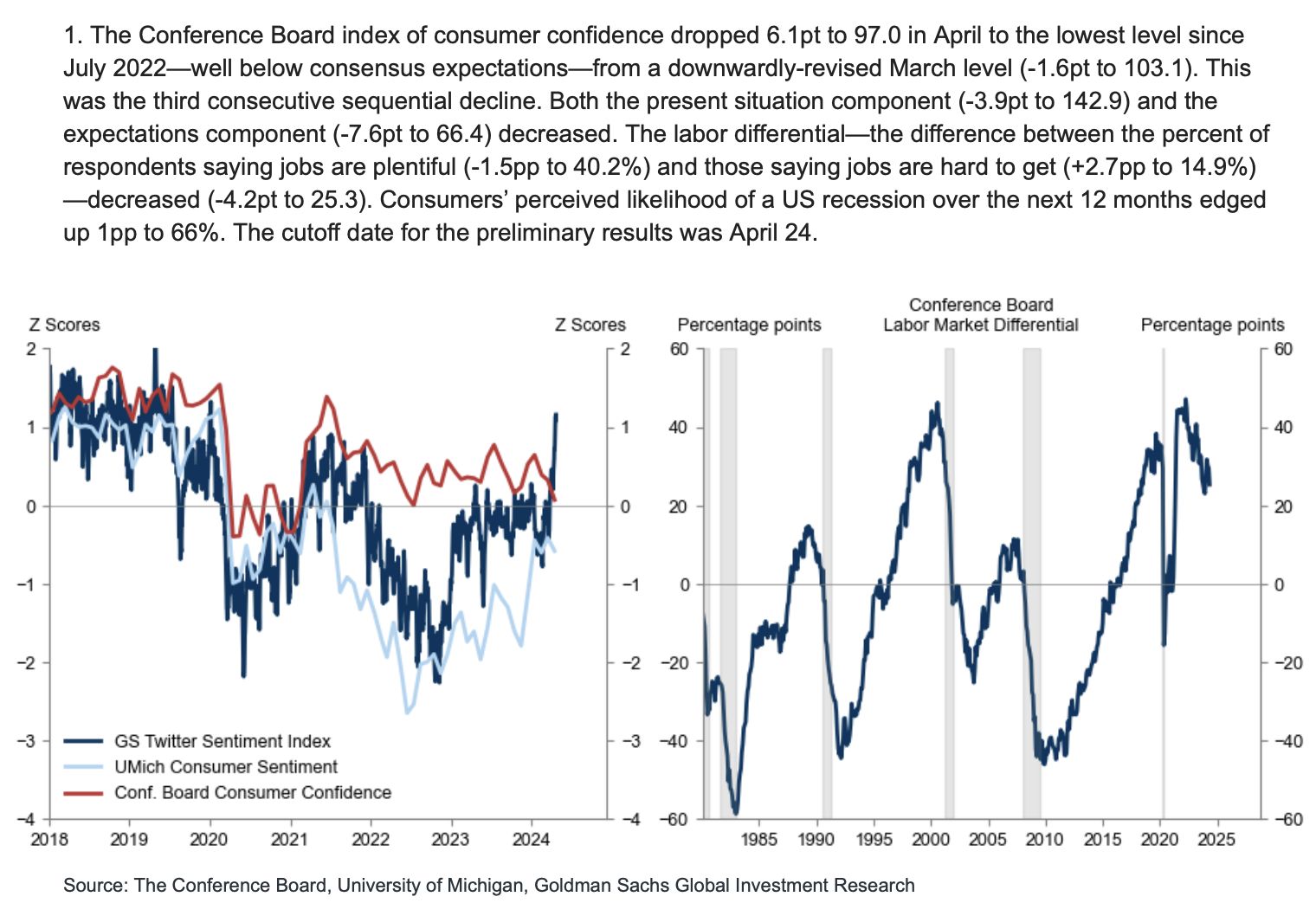

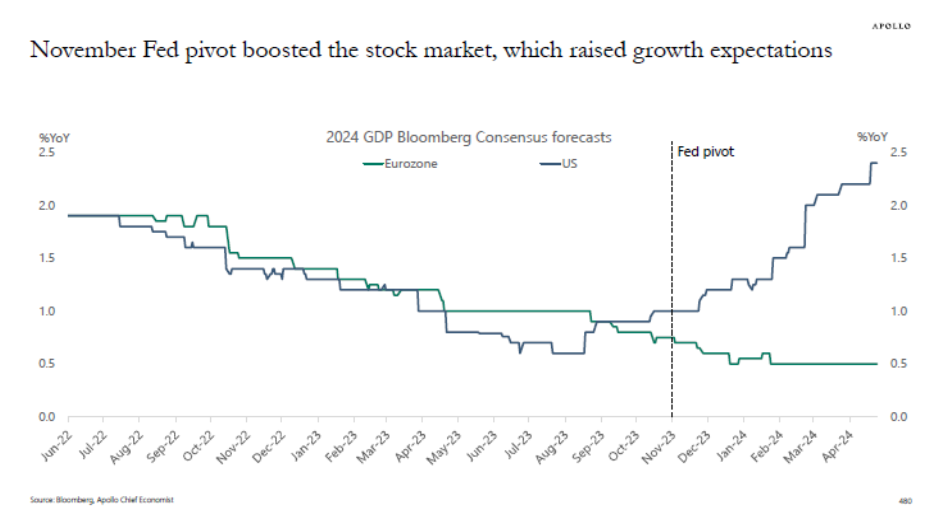

Observers are buzzing that the labor market is cooling, with job openings and quits on the decline, and the Fed Chair says rates are still restrictive. Still, the phrase ‘higher for longer’ makes housing professionals weep. Thankfully, the Fed kept rates steady. My friend Barry Ritholtz has a mega post with charts galore on why the Fed should actually be cutting already.

See what everyone is buzzing about. The entire clip. It’s relatable and it’s worth it.

Did you miss last Friday’s Housing Notes?

April 26, 2024: The ‘I Palindrome I’ Effect: Housing Market Conditions Look The Same Backwards And Forwards

But I digress…

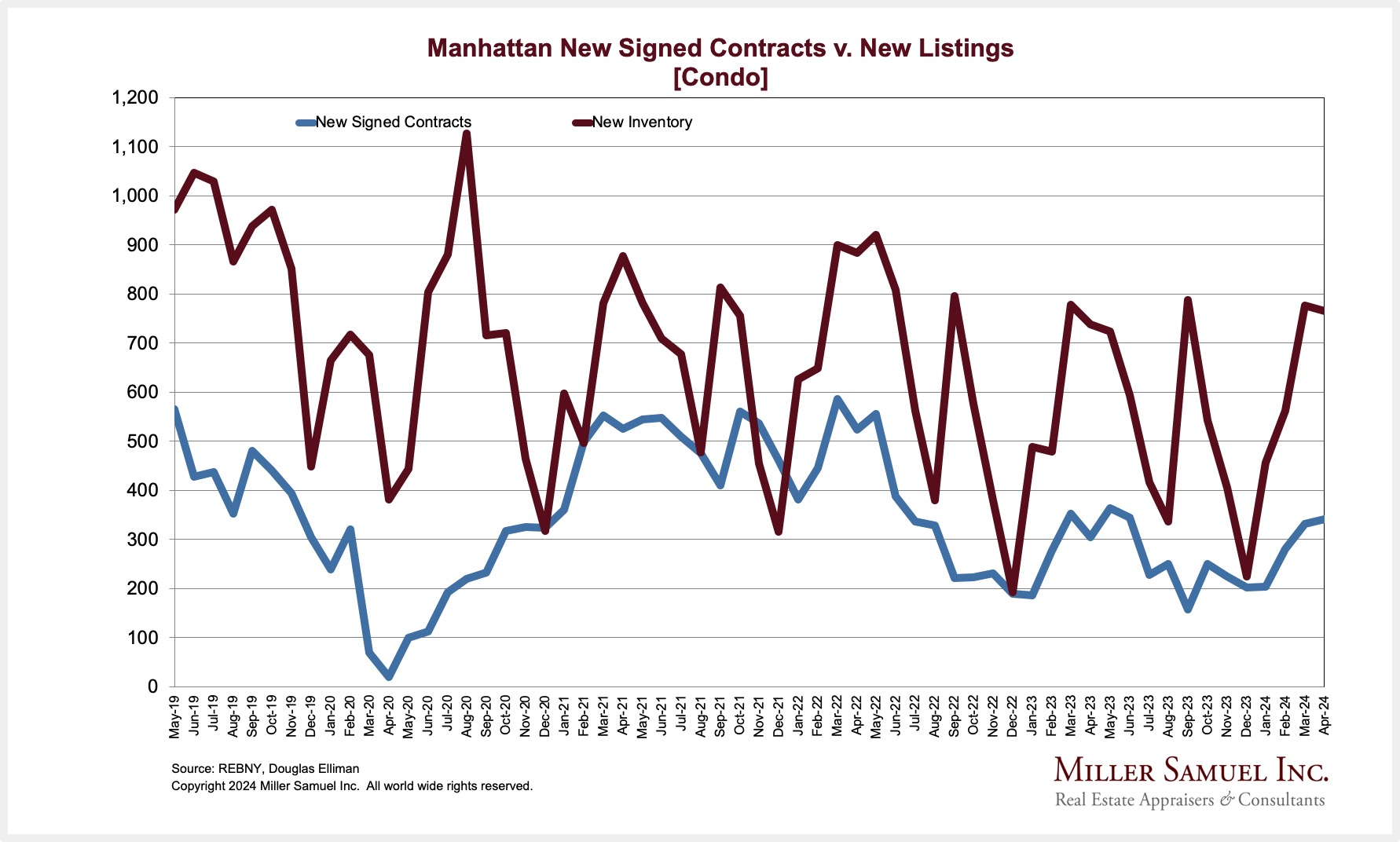

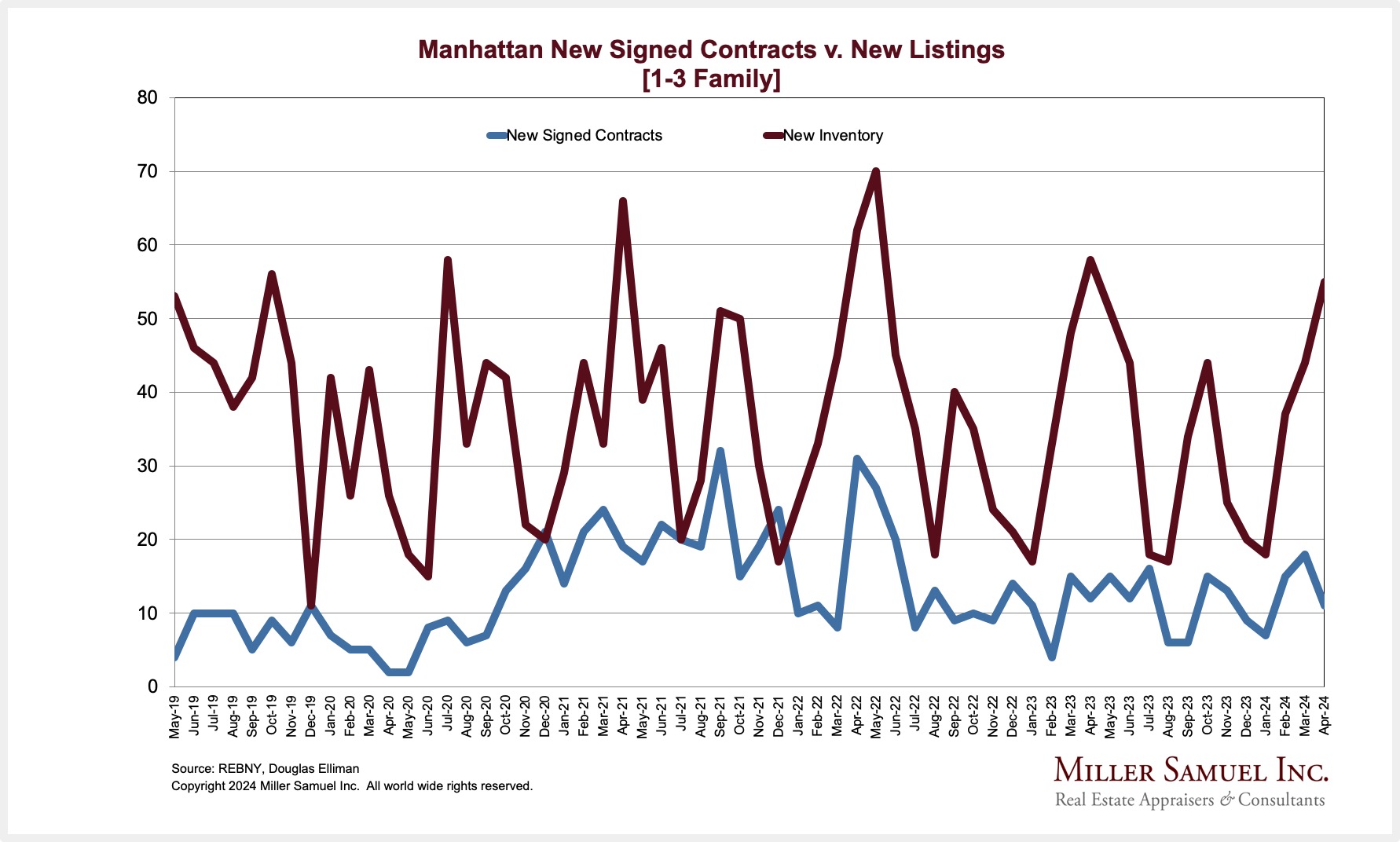

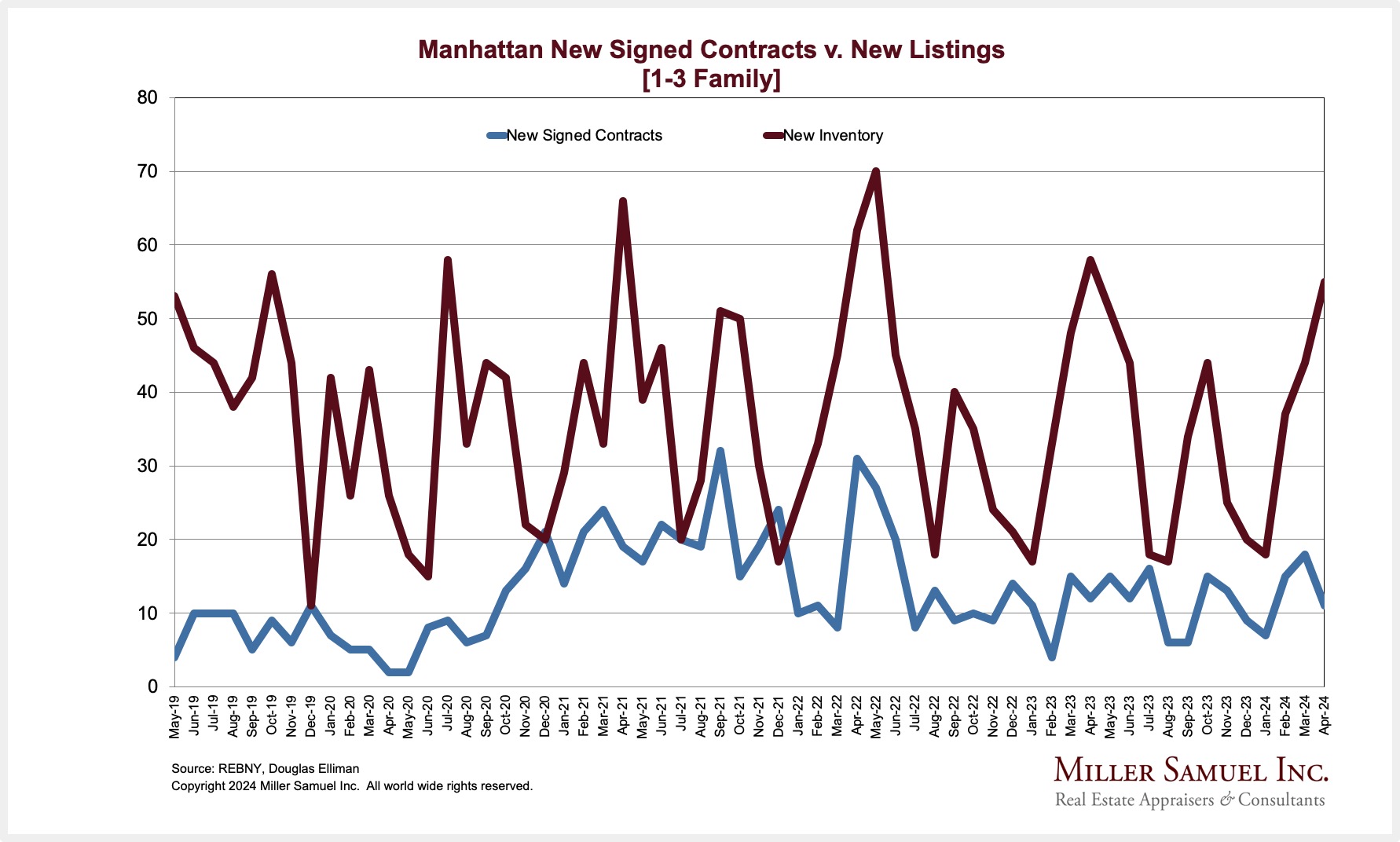

New York Condos Are Leading The Way With More New Signed Contracts

I’ve been the author of a series of market reports since 1994 for Douglas Elliman. This new signed contract series evolved during the pandemic, covering the NYC metro area.

Elliman Report: April 2024 New York New Signed Contracts

Here’s a sampling. There are lots more on our website.

My 21st Time On NYT A1 – Hudson Yards Commercial Offices Not A Ghost Town, But Residential Absorption Is Slower Than Market

While I am a meticulous keeper of lists and absolutely remember that only amateurs count, I still thought it was cool to be in an article mentioned on the NYT (A1) front page last week for the 21st time: How Hudson Yards Went From Ghost Town to Office Success Story. My first A1 visit was in 2000, so my annual A1 appearance rate is a little less than once yearly, but who’s counting?

Small Is The New Big?

It seems like it, with rising prices, but let’s not overhype it just yet. Here’s the listing in Delray Beach, Florida, featured in the video.

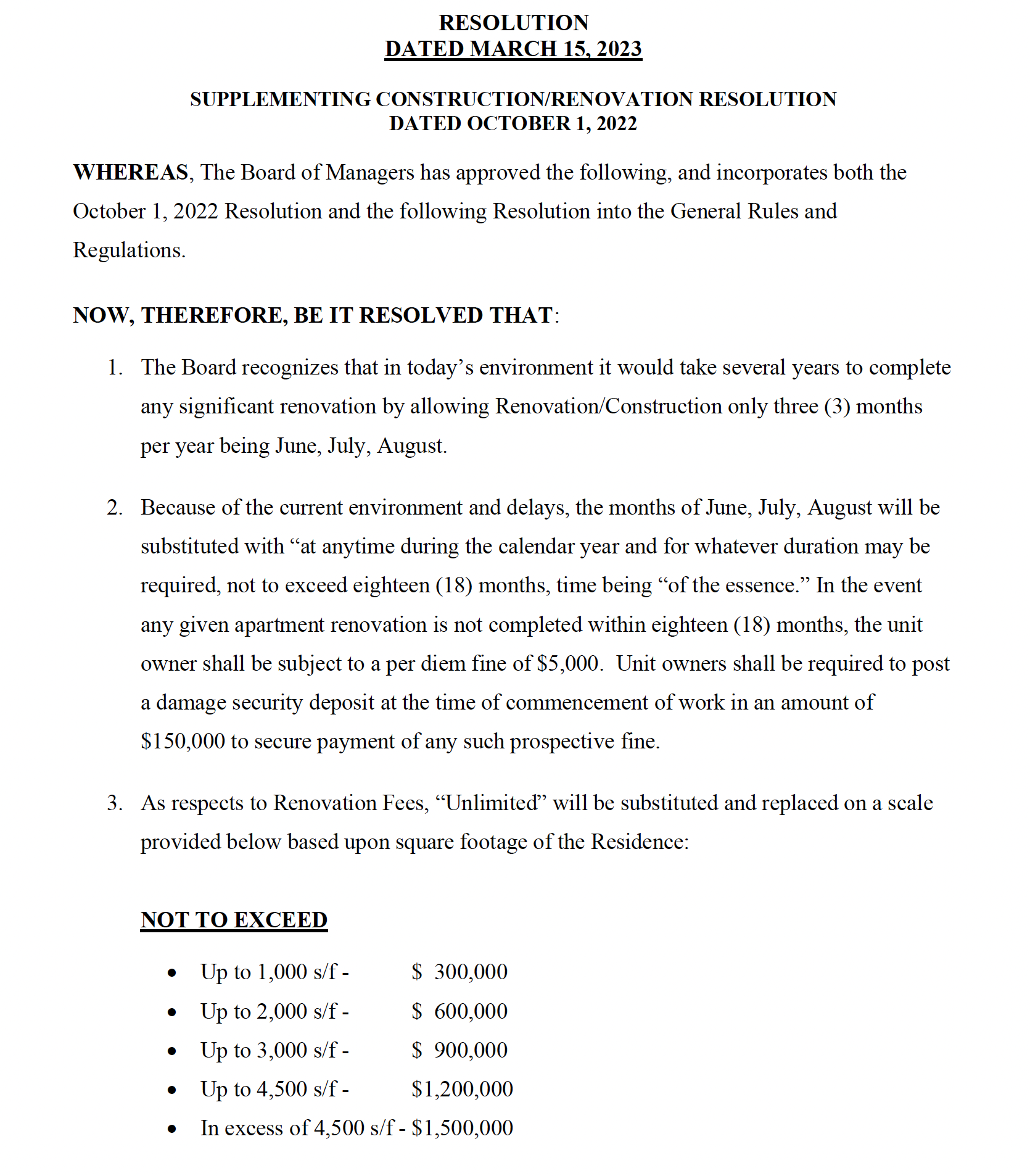

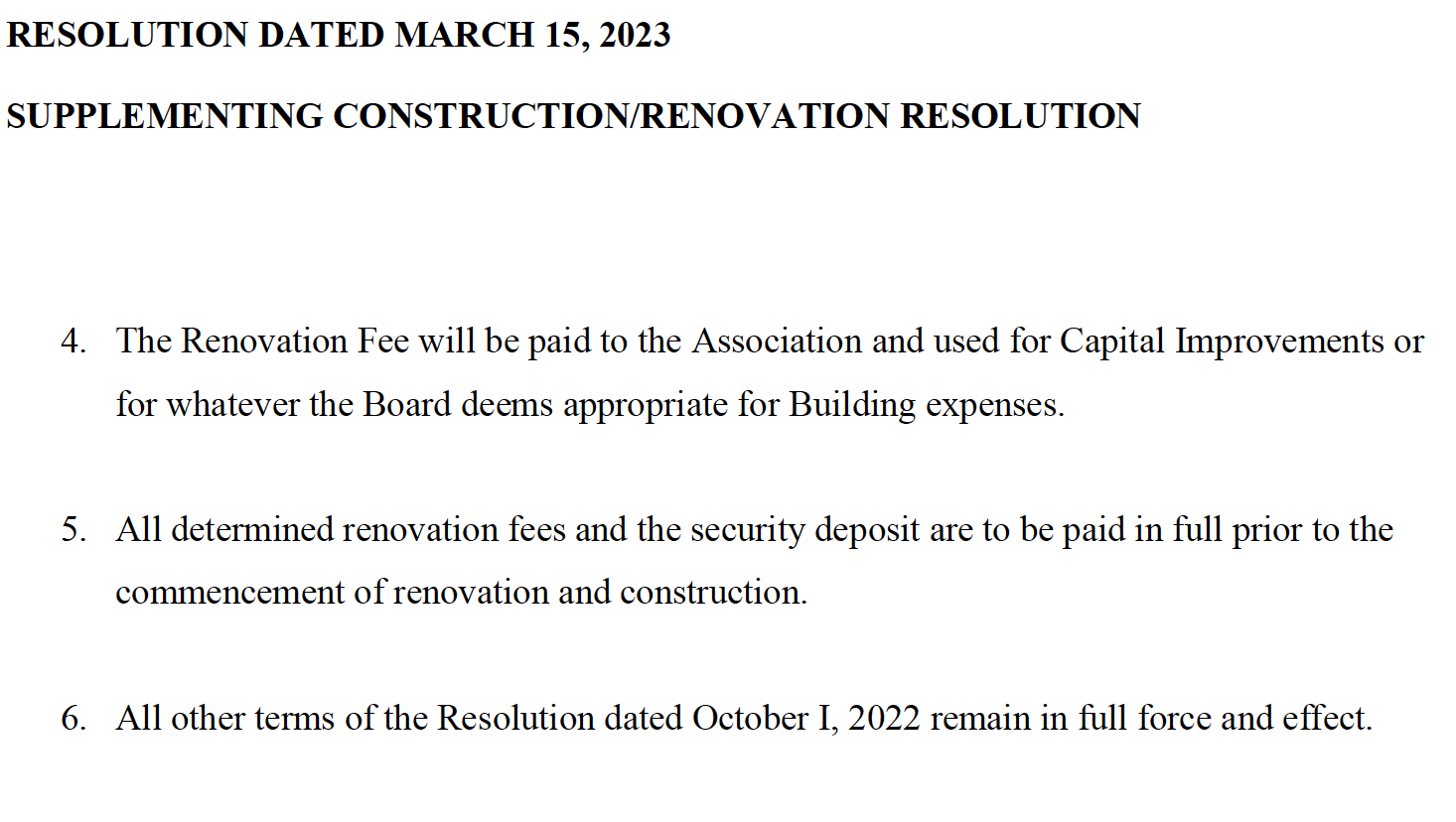

How A Manhattan Condo Association Discourages Renovation With Draconian Rules That Damage Value

I’m keeping the building address anonymous for now, but clearly, the association is working against its members’ best interests. Renovations influence overall values higher. Look at the cost list when undertaking a renovation. They’re arbitrarily charging an extra $300,000 for a 1,000-square-foot unit on top of the unit owner’s construction cost. That’s absurd. If the address gets out to the market, sales will probably end, and I hope unit owners will sue the association for damages. You can’t add any more damage to market value than this.

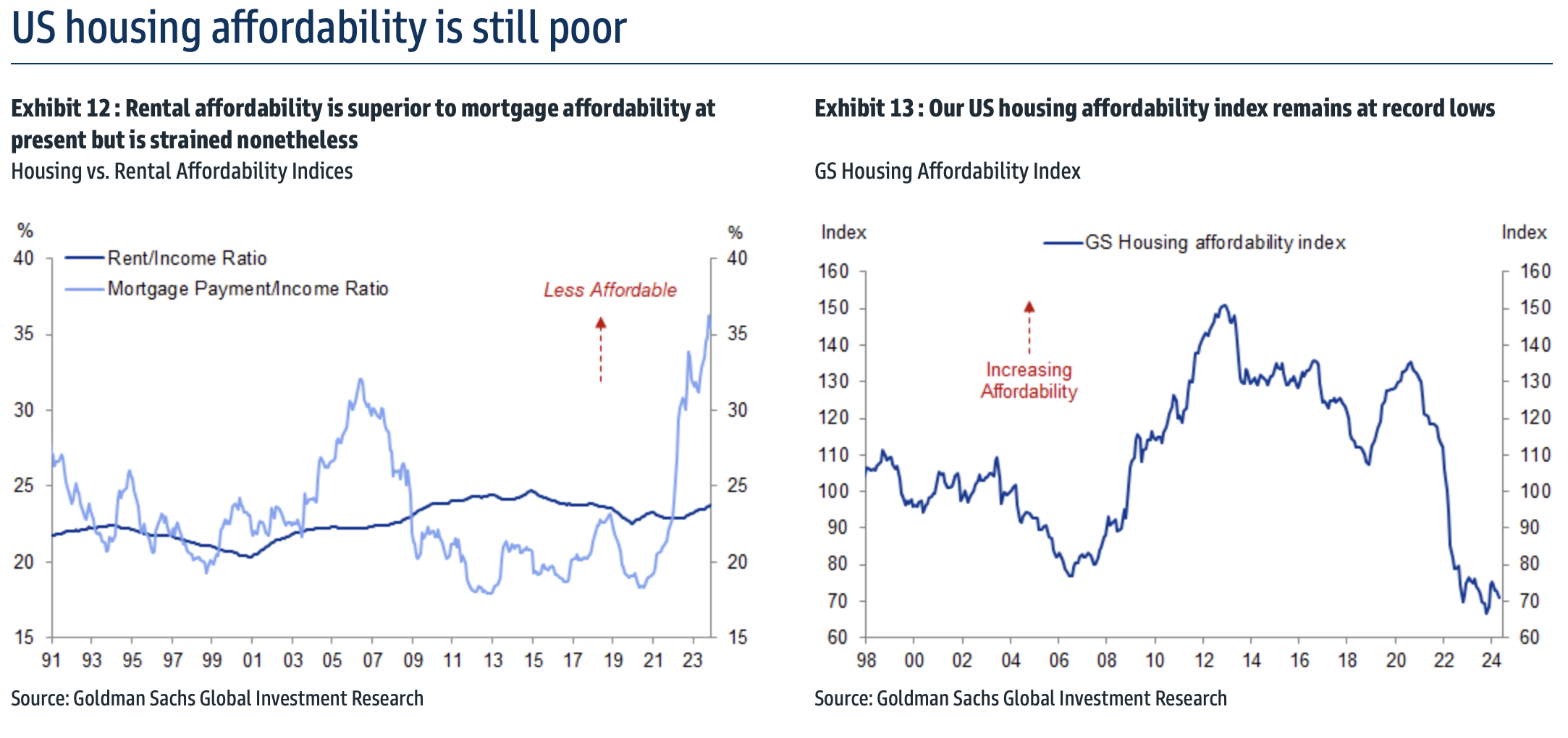

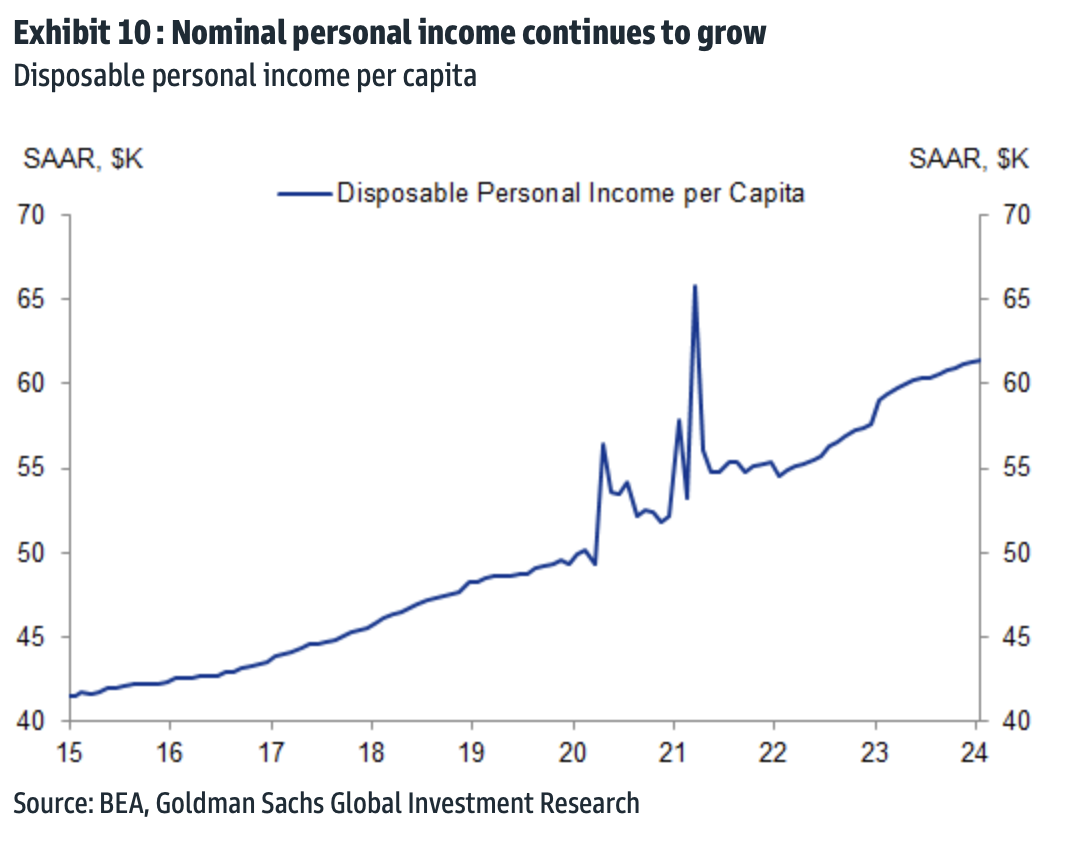

The Big Picture – Why The Fed Should Cut Now

Barry Ritholtz lays out the clear rationale as to why the Fed should be cutting now in his clear visual way that he has mastered. Shelter is 40% of CPI, and the rental equivalents they track lag actual conditions by 18 months, so…cut now.

Almost two-thirds of all existing leases for apartments or house rentals get renewed. Nearly all of these renewals were signed one or two years ago. Leases are contracts, and they lay out the specific terms for renewals within the document.

Barry Ritholtz Big Picture Blog

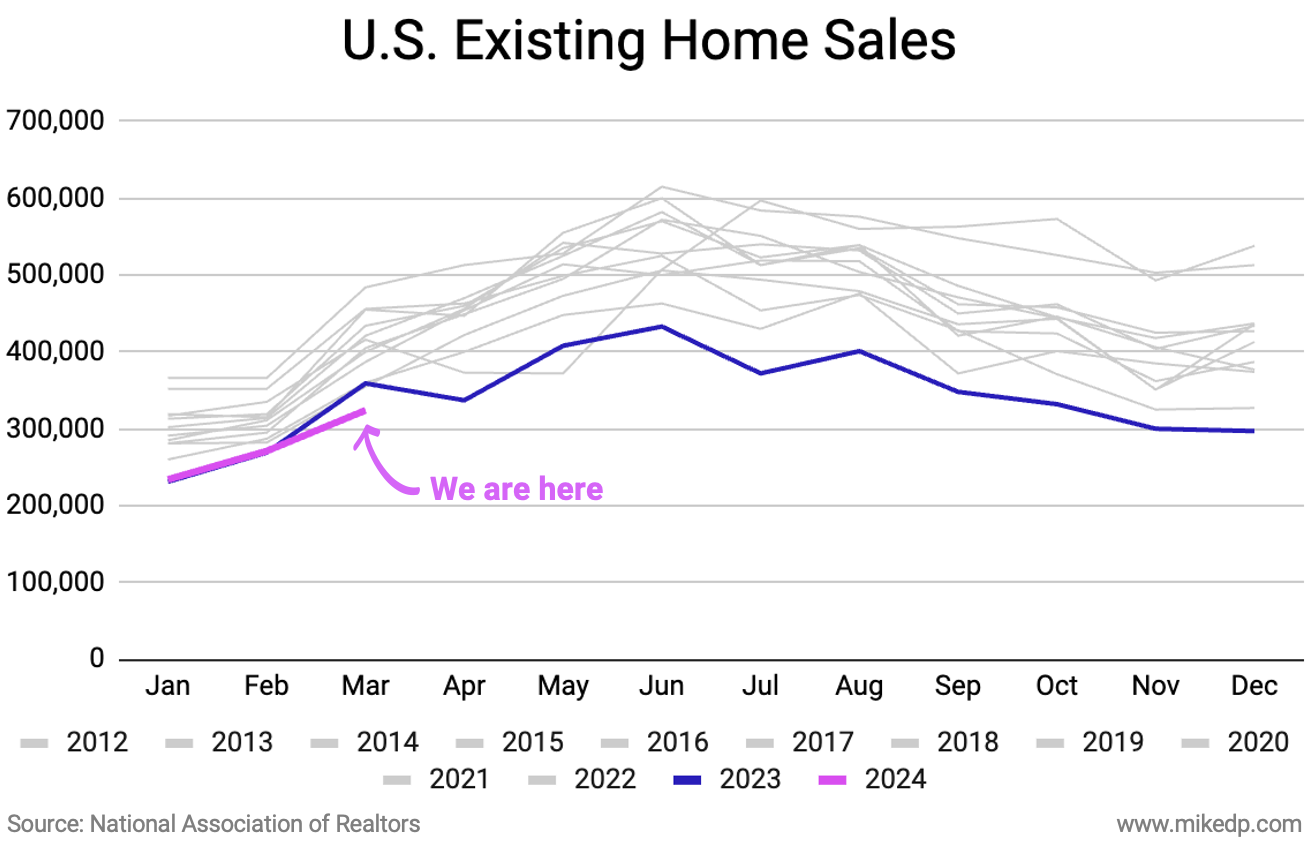

For Every 1% The Prevailing Mortgage Rate Exceeds The Origination Rate, The Probability Of A Sale Drops 18.1%

Torsten Slok, the economist, shared this paper on the percentage impact of the lock-in effect, something well chronicled here in Housing Notes. Here’s the abstract:

People can be “locked-in” or constrained in their ability to make appropriate financial changes, such as being unable to move homes, change jobs, sell stocks, rebalance portfolios, shift financial accounts, adjust insurance policies, transfer investment prof- its, or inherit wealth. These frictions—whether institutional, legislative, personal, or market-driven—are often overlooked. Residential real estate exemplifies this challenge with its physical immobility, high transaction costs, and concentrated wealth. In the United States, nearly all 50 million active mortgages have fixed rates, and most have interest rates far below prevailing market rates, creating a disincentive to sell. This paper finds that for every percentage point that market mortgage rates exceed the origination interest rate, the probability of sale is decreased by 18.1%. This mortgage rate lock-in led to a 57% reduction in home sales with fixed-rate mortgages in 2023Q4 and prevented 1.33 million sales between 2022Q2 and 2023Q4. The supply reduction increased home prices by 5.7%, outweighing the direct impact of elevated rates, which decreased prices by 3.3%. These findings underscore how mortgage rate lock-in re- stricts mobility, results in people not living in homes they would prefer, inflates prices, and worsens affordability. Certain borrower groups with lower wealth accumulation are less able to strategically time their sales, worsening inequality.

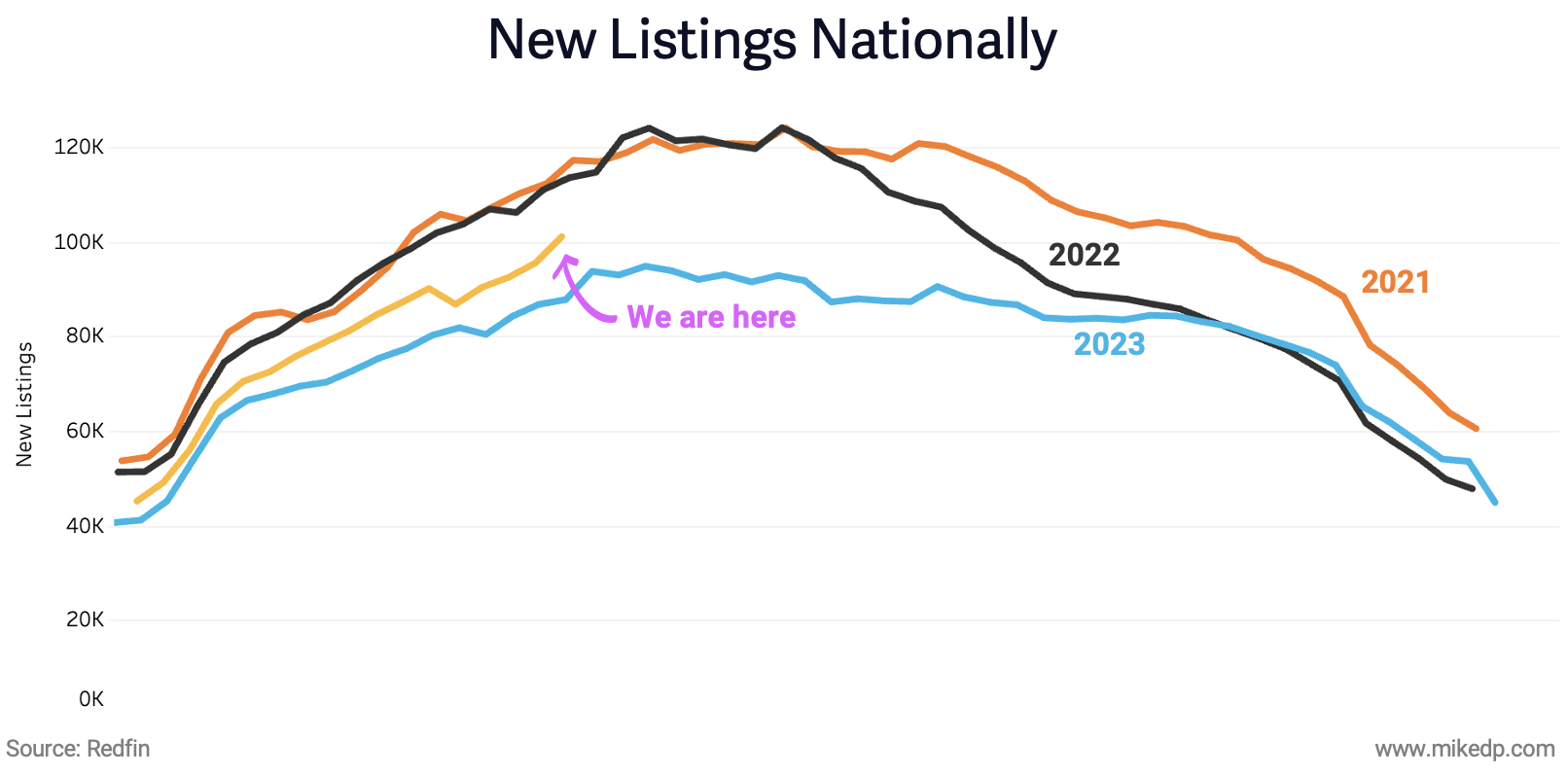

Limited Availability Of Listings May Last For Years

Recently, REALTOR Magazine interviewed me and asked me to explain the “why” of listing inventory shortages nationwide. Part of my answer is captured in this quote. Also, note the interesting chart on buyers’ and sellers’ market participation by age.

“Lower mortgage rates seem to be the only way to bring in more listings—reducing the spread between the prevailing mortgage rate and the 3% rates homeowners locked in,” says Jonathan Miller, CEO of appraisal firm Miller Samuel Inc. in New York and author of the Housing Notes newsletter. “At the same time falling rates increase demand, steadily rising prices make for an inventory stalemate that may last for several years,” Miller says.

REALTOR Magazine

Highest & Best Newsletter: 🛒 Blackstone Shops Florida

If you’re interested in the Florida housing market, you should sign up for this Florida newsletter, Highest & Best, from Oshrat Carmiel, formerly of Bloomberg News…

This week’s post:

🛒 Blackstone Shops Florida – What’s in the cart? Plus: A bold Miami office price; Ritzy Boca

Another NAR Settlement But With Cash Considerations

I don’t know this agent, but he points out that this particular settlement by Douglas Elliman – the firm I do my market reports for – seemed quite different from others I’ve read about in this wave of class-action settlements.

[Mike DelPrete] Mixed Messages? You Bet

Mike DelPrete burst onto the real estate tech scene several years ago and presents this real estate subset in easy-to-understand presentations.

Here’s his latest post: Mixed Messages in the Market

Speaking In The Clouds

Yesterday, I spoke at a broker event of about 75 people in a spectacular 60th-floor penthouse listing in the Nomad neighborhood of Manhattan.

I arrived early and the clouds blocked the views!

As an appraiser, I rarely get to see high-floor apartments in the evening. However, they are usually spectacular, as the photos below show.

5 Charts On How Goldman Sachs Looks At The Housing Market Right Now

Getting Graphic

Favorite housing market charts of the week of our OWN making

Favorite housing market/economic charts of the week made by OTHERS

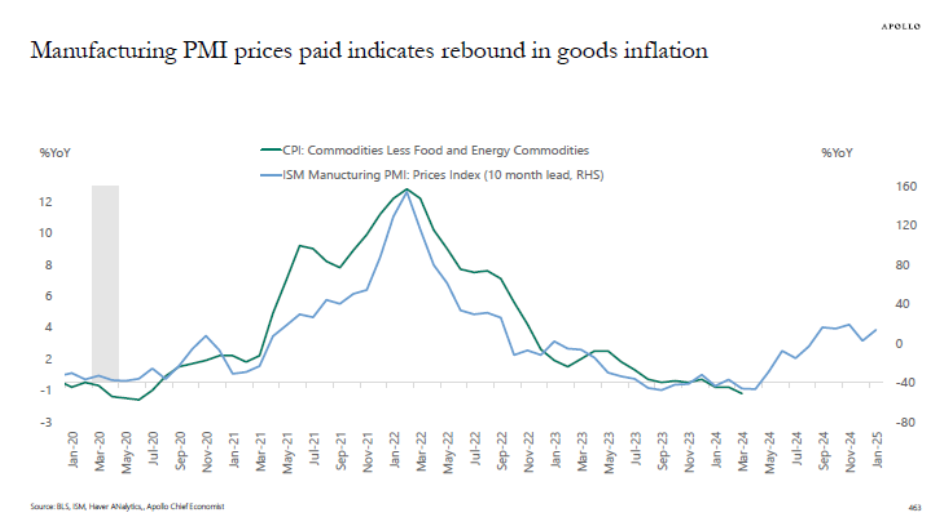

Apollo’s Torsten Slok‘s amazingly clear charts

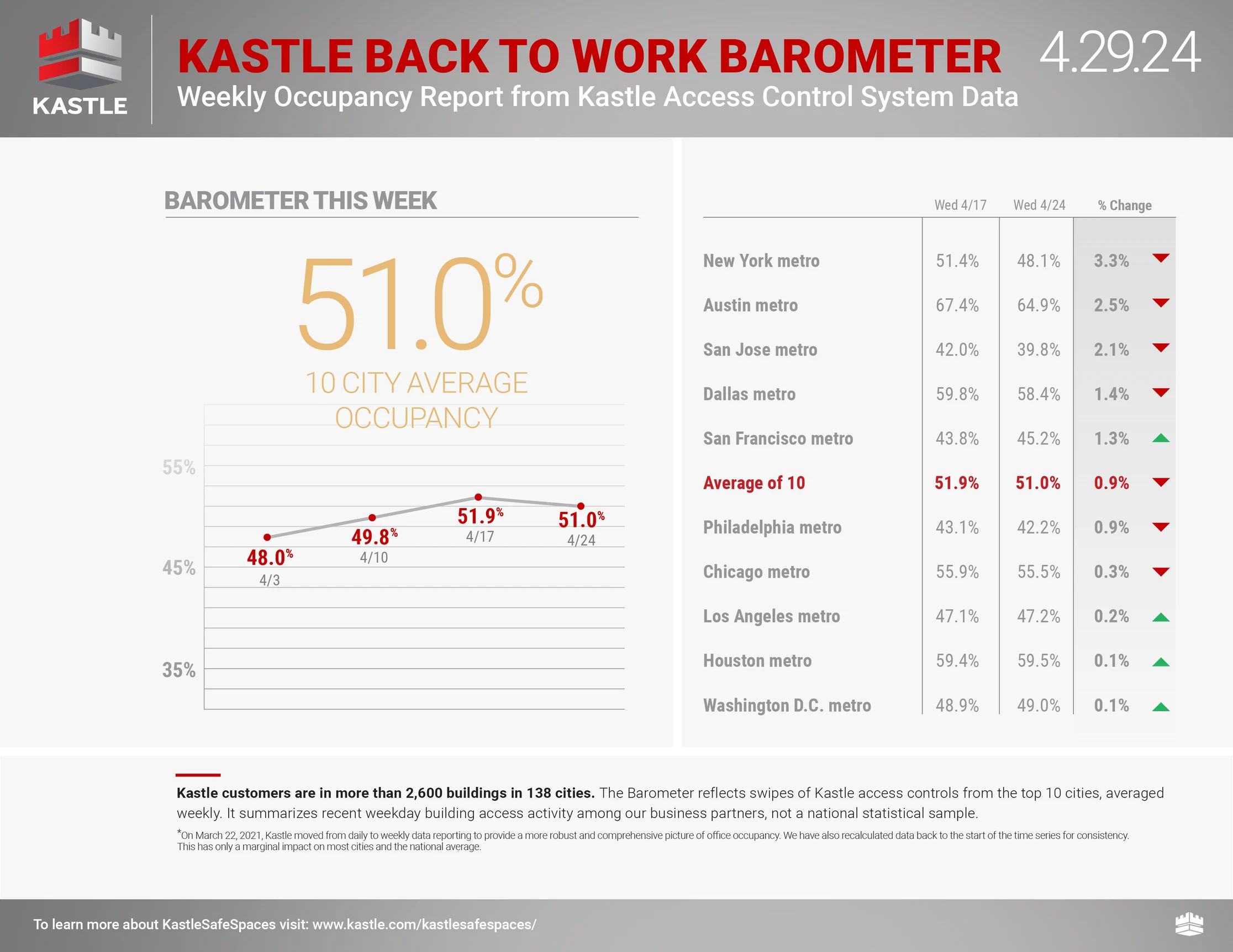

Kastle card swipe data

Remember that Kastle charts are overstating occupancy* because their pre-pandemic occupancy benchmark was 100%, which is incorrect (*measures card swipe activity as a proxy for occupancy). Still, they’ve become the standard benchmark for occupancy rates.

Appraiserville

Kelly’s Listening Tour Forgot The Listen Part

“Why can’t we just get along?” is the refrain as new TAF president Kelly Davids visits all the stakeholders in the mortgage process before and now at the AARO conference in Nashville. Her “listening tour” comprises mainly of Kelly talking and the stakeholders listening. With Lyin’ Dave hired as an outside consultant now that he has retired, we all know LD continues to run TAF, keeping the status quo and collecting his bloated paycheck. But I’m willing to give Kelly a chance to change the direction of TAF to be inclusive and come up with other entry points into the profession besides mentoring. But I think my odds of winning the lottery are much better. It is absolutely possible, but in reality, it is a mega longshot because of Lyin’ Dave’s 33-year legacy

For the uninitiated, TAF is the organization that wrote the bat-shit crazy letter, the chickenshit letter, and is the subject of an active investigation by HUD on whether USPAP promotes a lack of diversity in the appraisal profession (400th out of 400 occupations, according to BLS in 2021). As a reminder, TAF president Dave Bunton called me a liar in a public forum in Washington, D.C., as he was lying (not under oath) – hence his new nickname “Lyin’ Dave,” a.k.a. “LD.”

The Appraisal Subcommittee Now Has A Landing Page For The 4 Hearings On Appraisal Bias

Hearings on Appraisal Bias [ASC.gov]

I love that Lyin’ Dave’s statements of misinformation about me and his having played no role in selecting Kelly to replace him have been memorialized in the video and the transcripts. Also, it captures Michelle Bradley’s unprompted shout out to me at the second hearing because she still didn’t understand her conflict of interest with McKissock that a functioning board outside of TAF-world would never allow.

AI FOJ Steve Roach Specializes In Character Assassination

The last time I spoke about Mr. Roach, I commented on the fact that he was on six committees. I subconsciously thought he thought no one else deserved more than he and no one else more qualified to hold six committee positions in the 17,000-member organization. Or because, as an FOJ who is well known for getting others to do his dirty work, spreading untruths about others to help his status in the organization is his skill.

With FOJs like Mr. Roach, it’s all about the grift and backstabbing to gain status. After then-President Craig Steinley removed Mr. Roach from the prestigious Body of Knowledge Committee that he had been off and on for years while the JA and Sellers posse were in control, current president Sandy Adomatis, a hardcore FOJ who is trying to bring back JA and grift, put him back on it. So, what would an accomplished appraiser from San Diego do? I’m being told he is smearing Craig Steinley behind his back and using other people to do the dirty work, which is always his MO, anyway. This Roach shouldn’t be anywhere near a committee for the rest of his career with this kind of shameful behavior.

The deadline to submit recommendation letters for Tank FOJ and Craig Steinley was today at noon central time, which is now past us. On May 8th, the Board will have the winner in hand but won’t announce for 30 days if the sham petition process is implemented. If that happens, the winning vice presidential candidate will likely be announced at the August Board meeting.

Instead of unethical behavior for a professional organization, I have a novel idea: Encourage the board to vote based on qualifications. Craig showed real leadership in fixing broken things to move the organization forward. One of those actions was creating a search committee to find an exceptional leader in Cindy Chance as CEO and fix the long-fading education process. What has FOJ Tank done other than be a yes man for JA? Please let me know since I’m drawing a blank.

To the AI membership. This is probably your last chance to purge the unethical grift that FOJs represent to your organization. Don’t let this opportunity to steer the organization in the right direction pass you by so the FOJs can return to flying first class to Europe and China with their emotional support spouses. Please push for Craig Steinley to restore this once-great organization to relevancy again. Adding your fantastic CEO was an important first step, but there is more work to do.

Thoughts from a Former AI Board Member

This was shared with me, and it articulates the selection of vice president far more professionally than I did above:

“There is in the worst of fortune the best of chances for happy change.” – Euripides

I have had the misfortune of seeing the Appraisal Institute in a stultifying bureaucratic culture that would rather mislead the board of directors than actively pursue change. It got to the point where the board of directors was divided into two camps where one side wanted to maintain the status quo while the other side actively advocated for change. All of this was because the leaders of the organization failed to adapt to new market realties, or increasing challenges, in staffing, membership decline, education and finances. Leadership seemed to be pursuing an agenda that focused on the benefits that could be accrued to themselves rather than what benefits the organization could supply to its members or the public at large.

I have also had the good fortune to see energetic leaders turn moribund organizations such as the Appraisal Institute around. Craig Steinley and others were able to change the culture at the Appraisal Institute and start it on the path toward success. I watched as Craig accomplished this turnaround by first identifying the problems in the organization that needed change. He then identified supporters of his vision and those who were opposed. He was honest with both groups, which allowed him to implement much-needed innovation culminating in the hiring of a new Chief Executive Officer who is pursuing a reorganization plan that puts members first.

I feel the Appraisal Institute dodged a bullet that hit its mark at the National Association of Realtors and the National Rifle Association. Both of those organizations are reeling from lawsuits and self-dealing by their leadership. The Appraisal Institute was on that same path until Craig Steinley was elected to leadership.

Craig Steinley is the prime mover behind the change occurring at the Appraisal Institute. Mike Tankersley has always been an obstacle to change. Step forward with Craig Steinley for a better future or step backward with Mike Tankersley and embrace the decline. The future is scary, but I trust Craig Steinley’s vision of where the Appraisal Institute can go more than Mike Tankersley’s.

OFT (One Final Thought)

I could watch this all day.

Brilliant Idea #1

If you need something rock solid in your life – particularly on Friday afternoons at 2:00 PM, Eastern Time (ET) – and someone forwarded this to you, you can sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll buzz;

– You’ll sting;

– And I’ll drive off a cliff.

Brilliant Idea #2

You’re clearly full of insights and ideas as a reader of Housing Notes. Consider sharing them with me early and often. I appreciate every email I receive, as it helps me craft future Housing Notes.

See you next week!

Jonathan J. Miller, CRE®, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog @jonathanmiller

Reads, Listens and Visuals I Enjoyed

- Why the FED Should Be Already Cutting – The Big Picture [Ritholtz]

- Madison House, 15 E 30TH ST, PH60A New York, NY 10016 [Elliman Listing]

- 🛒 Blackstone Shops Florida [Highest & Best]

- Mixed Messages in the Market [Mike DelPrete – Real Estate Tech Strategist]

- The US Fed keeps interest rates steady [Semafor]

- Live: Analysis of Fed Rate Decision, Powell News Conference [Bloomberg]

- 5 brokerage settlements receive preliminary approval [Real Estate News]

- Douglas Elliman settles commission suits for up to $17.75M [Inman]

- The wild rise of Zillow Gone Wild [Washington Post]

- Zillow offering 7-day ‘touring agreement’ for agents [Real Estate News]

- Wall Street Has Spent Billions Buying Homes. A Crackdown Is Looming. [Wall Street Journal]

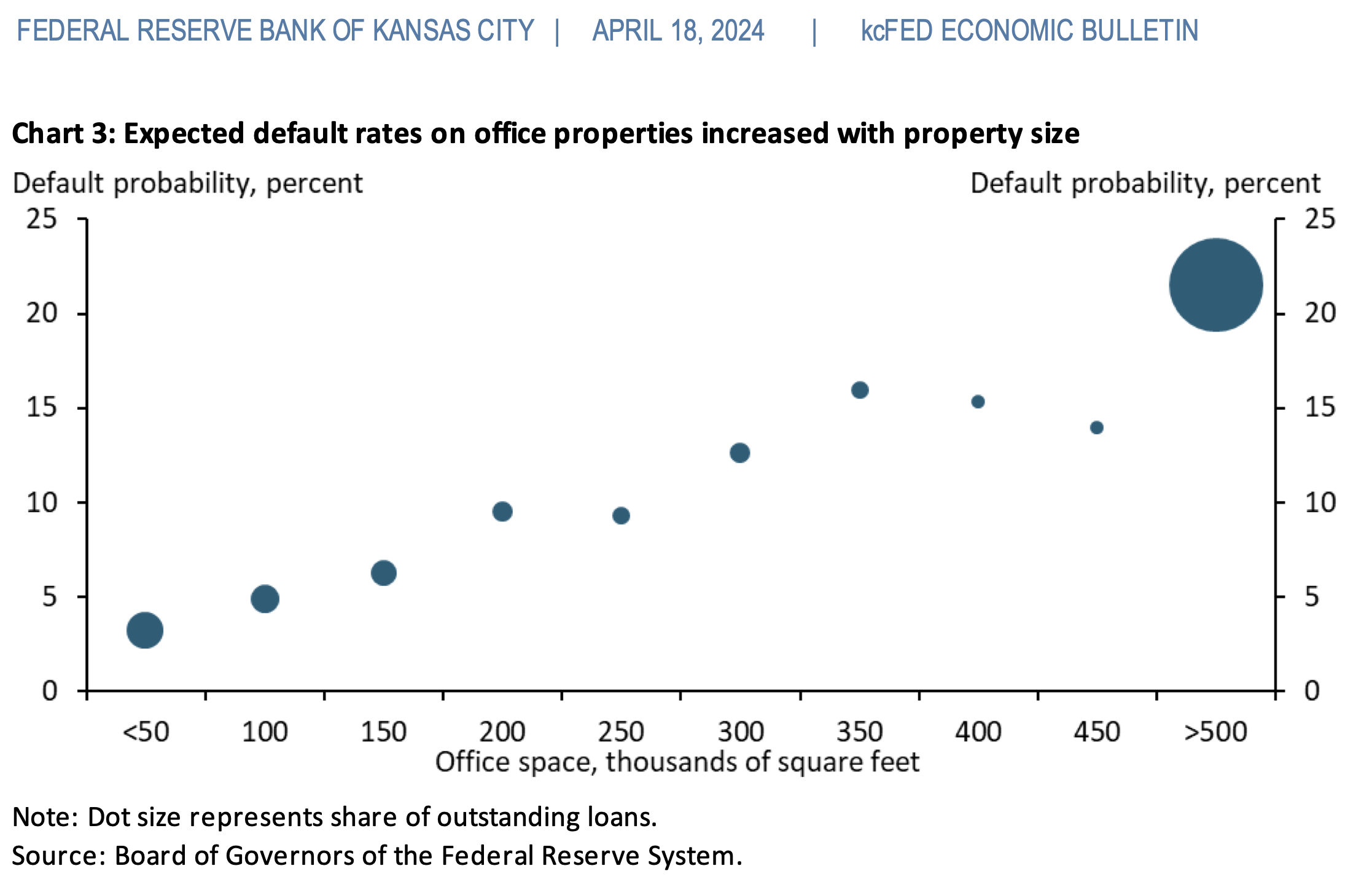

- Office-Loan Defaults Near Historic Levels With Billions on the Line [Wall Street Journal]

- Fed to Signal It Has Stomach to Keep Rates High for Longer [Wall Street Journal]

- Elliman settles broker commission lawsuits [The Real Deal]

- ‘It was heaven. It’s gone.’ Grove Isle residents say Miami broke laws to let tower rise [Miami Herald]

- Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes [Bloomberg]

- Exclusive | Regulators Set to Seize Troubled Philadelphia Bank Republic First [Wall Street Journal]

- Warren Buffett’s Real Estate Brokerage Agrees to $250 Million Settlement [NY Times]

My New Content, Research and Mentions

- The Next Chapter [NAR]

- What Ever Happened to the Three-Bedroom? [Curbed]

- Listings Surge In Hamptons, North Fork [The Real Deal]

- Home Sales Looking at Mild Spring Thaw, Not Bloom [The Real Deal]

- Stabilized NYC Rents Are Rising With Inflation. That’s Good. [Bloomberg]

- Aspiring homebuyers can pick up tips at workshop in Roosevelt [Newsday]

- Comeback of NYC Co-ops Offers Stability in Tight Market [The Real Deal]

- Million Dollar Homes Hot In Palm Beach County, Cheaper Homes Cool [BocaNewsNow.com]

Recently Published Elliman Market Reports

- Elliman Report: California New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Manalapan, Hypoluxo Island & Ocean Ridge Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Lee County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: San Diego County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Orange County Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Los Angeles Sales 1Q 2024 [Miller Samuel]

- Elliman Report: North Fork Sales 1Q 2024 [Miller Samuel]

- Elliman Report: Hamptons Sales 1Q 2024 [Miller Samuel]

Appraisal Related Reads

- New TAF president looks to the future News [Valuation Review]

- Some red flags for the housing market [Sacramento Appraisal Blog]

- Has the Birmingham Real Estate Market Changed Since 2023? [Birmingham Appraisal Blog]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)