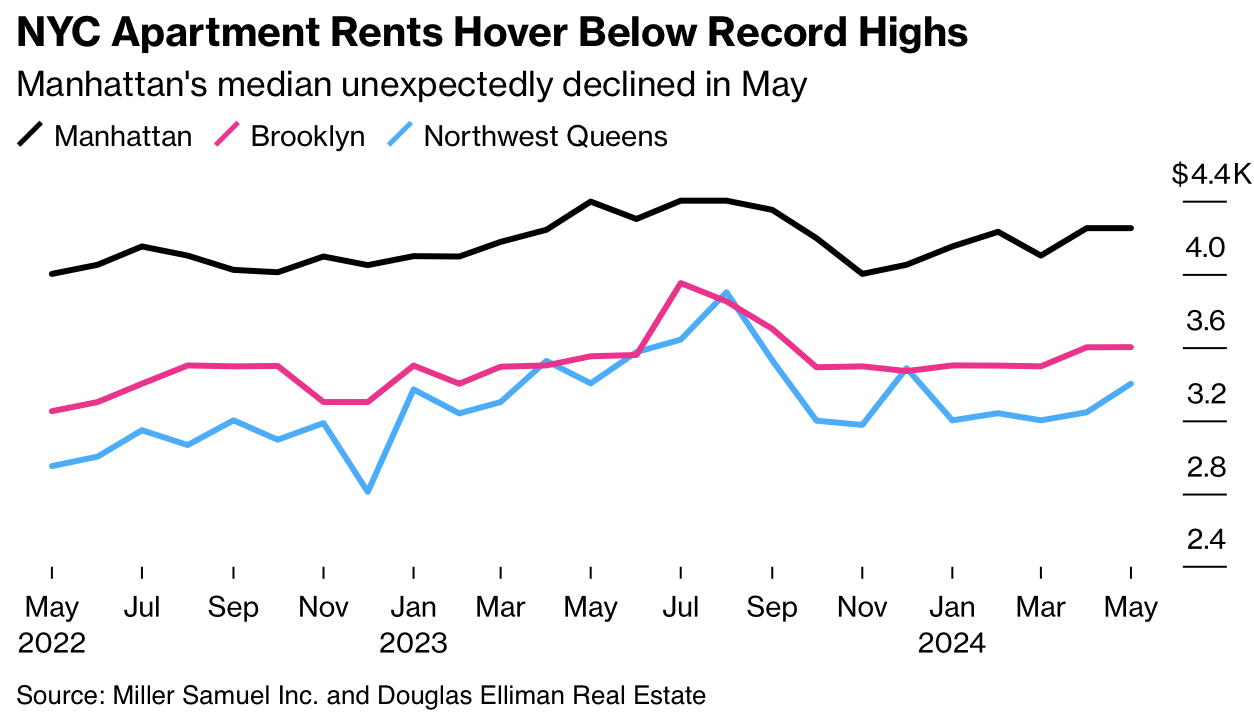

- Manhattan rents fell unexpectedly as Brooklyn & Queens rents barely budged

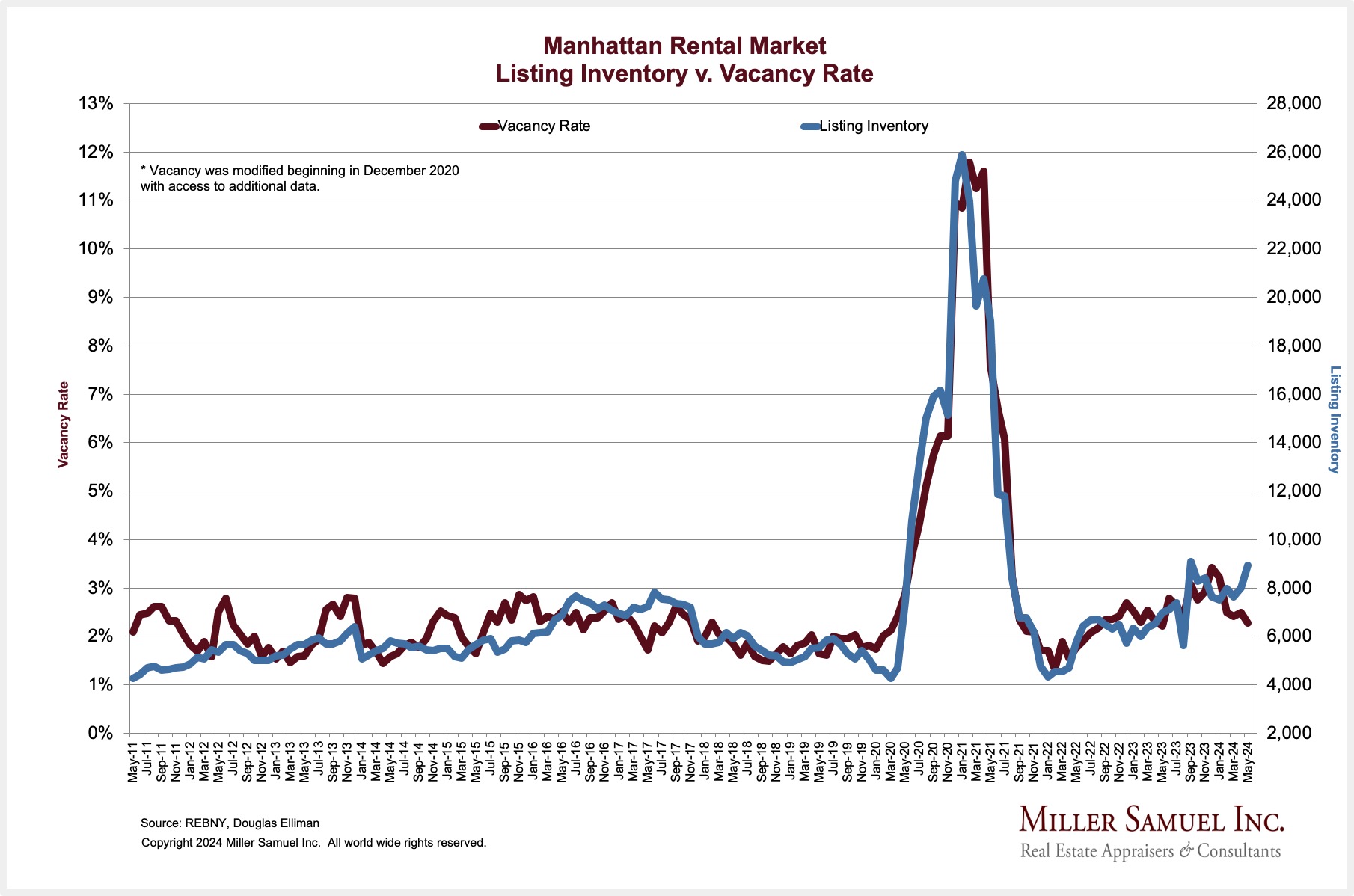

- New lease signings and listing inventory soared in New York City as churn persisted

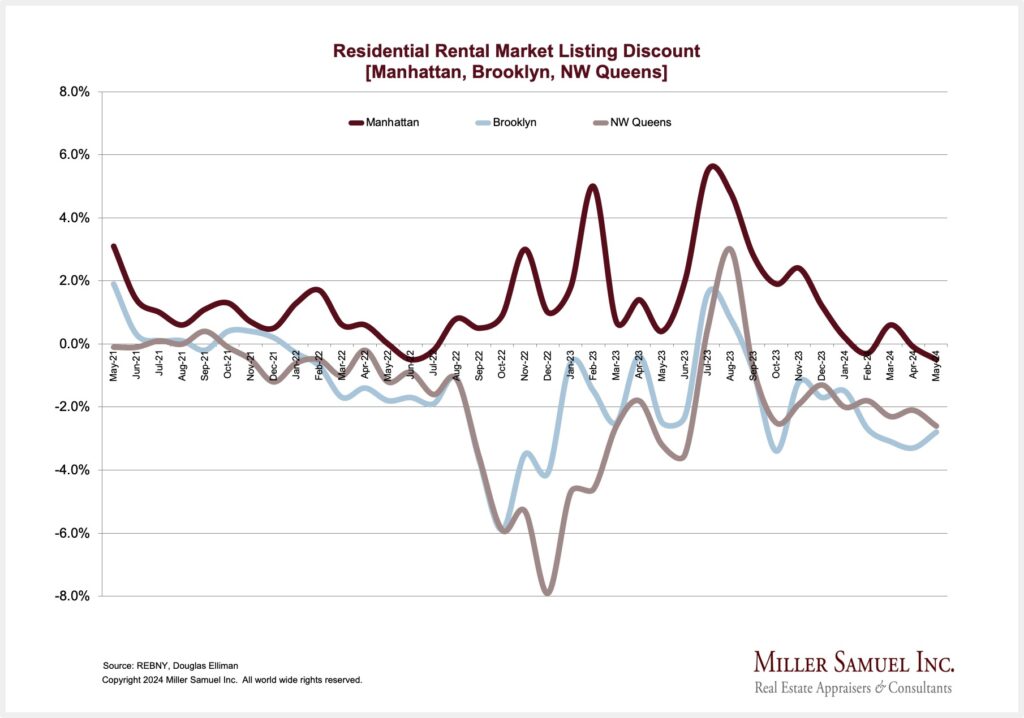

- Listing discounts go “negative,” reflecting the marketwide premium above ask

Elliman Report: May 2024 Manhattan, Brooklyn & Queens Rentals

The listing discount metric in the report is the percentage difference between the original listing rental price and the actual rental price. When the indicator goes negative, the discount becomes a premium. This means, as a market, the aggregate of all rental prices is higher than the aggregate of all rental asking prices, inferring the market remains tight.

In the following chart of listing discounts by borough, it is apparent that the rental market in the outer boroughs of New York City is much tighter than in Manhattan, showing listing “premiums” (negative listing discounts) for much of the past three years (overall rents are higher than overall asking prices). Manhattan’s listing discount has been consistently higher but showed a premium in the past few months.

Manhattan Rents

Or if you prefer the dark background version…

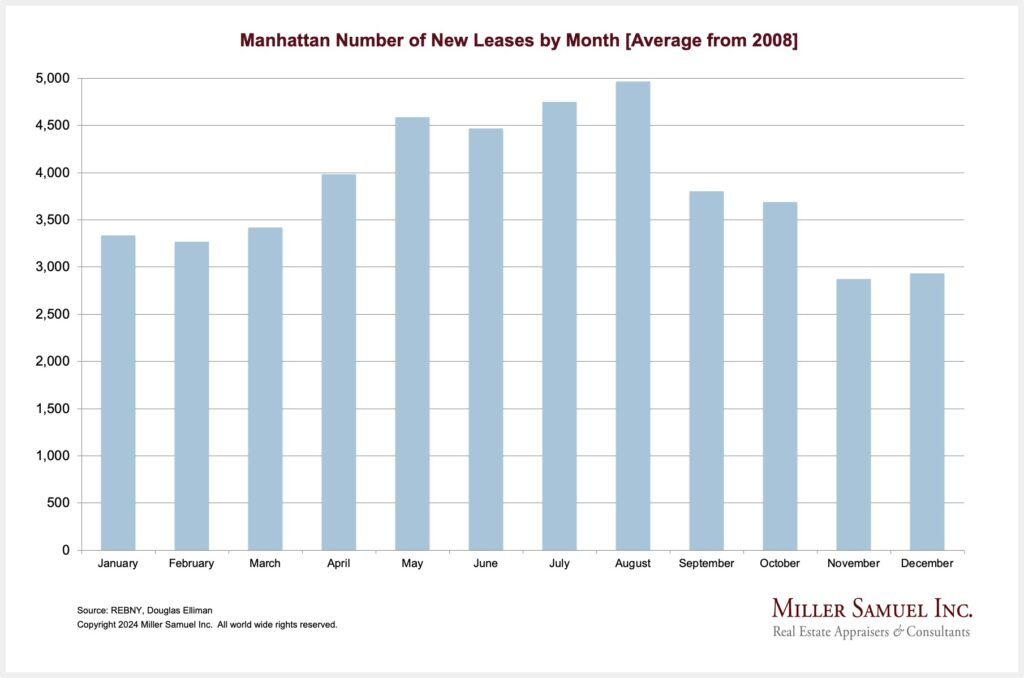

New lease signings have been surging all year and they don’t peak until August no matter the market conditions. These new leases represent about one-third of all activity while renewals account for the remaining two-thirds but that information is never shared by landlords. My theory for the substantial May surge in new lease signings begins in March.

…by quoting myself…

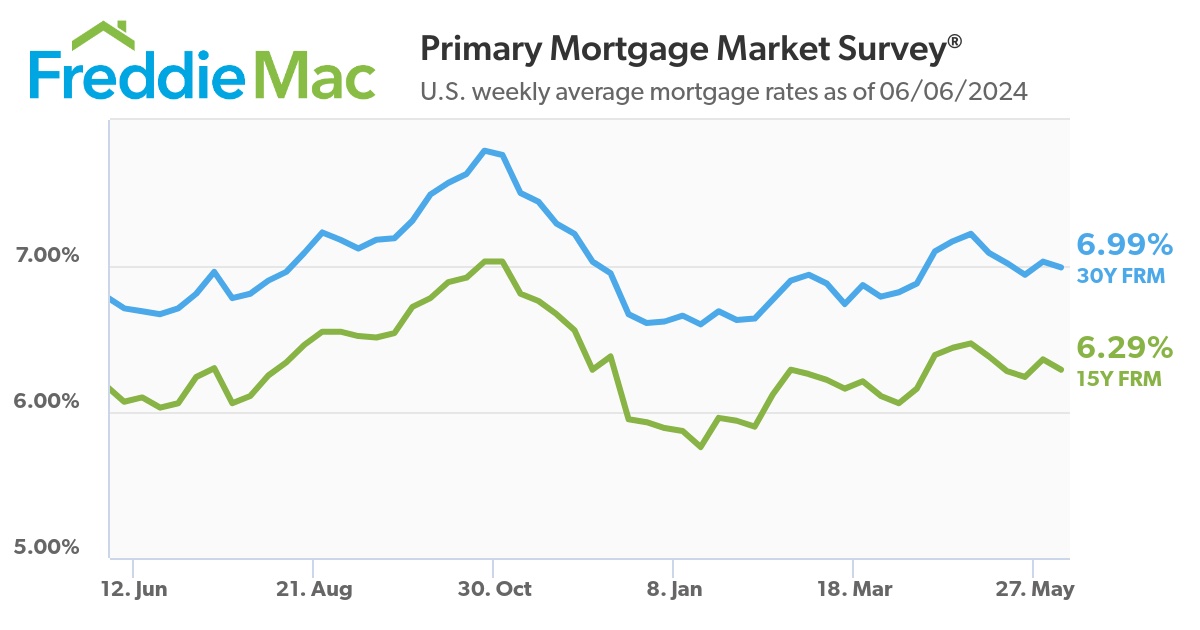

Miller said he thinks leasing is up in part because landlords are demanding renewal prices that are too high for their existing tenants, pushing those renters into the market. And with mortgage rates hovering near 7% in May, some would-be buyers instead choose to rent, he said.

Bloomberg

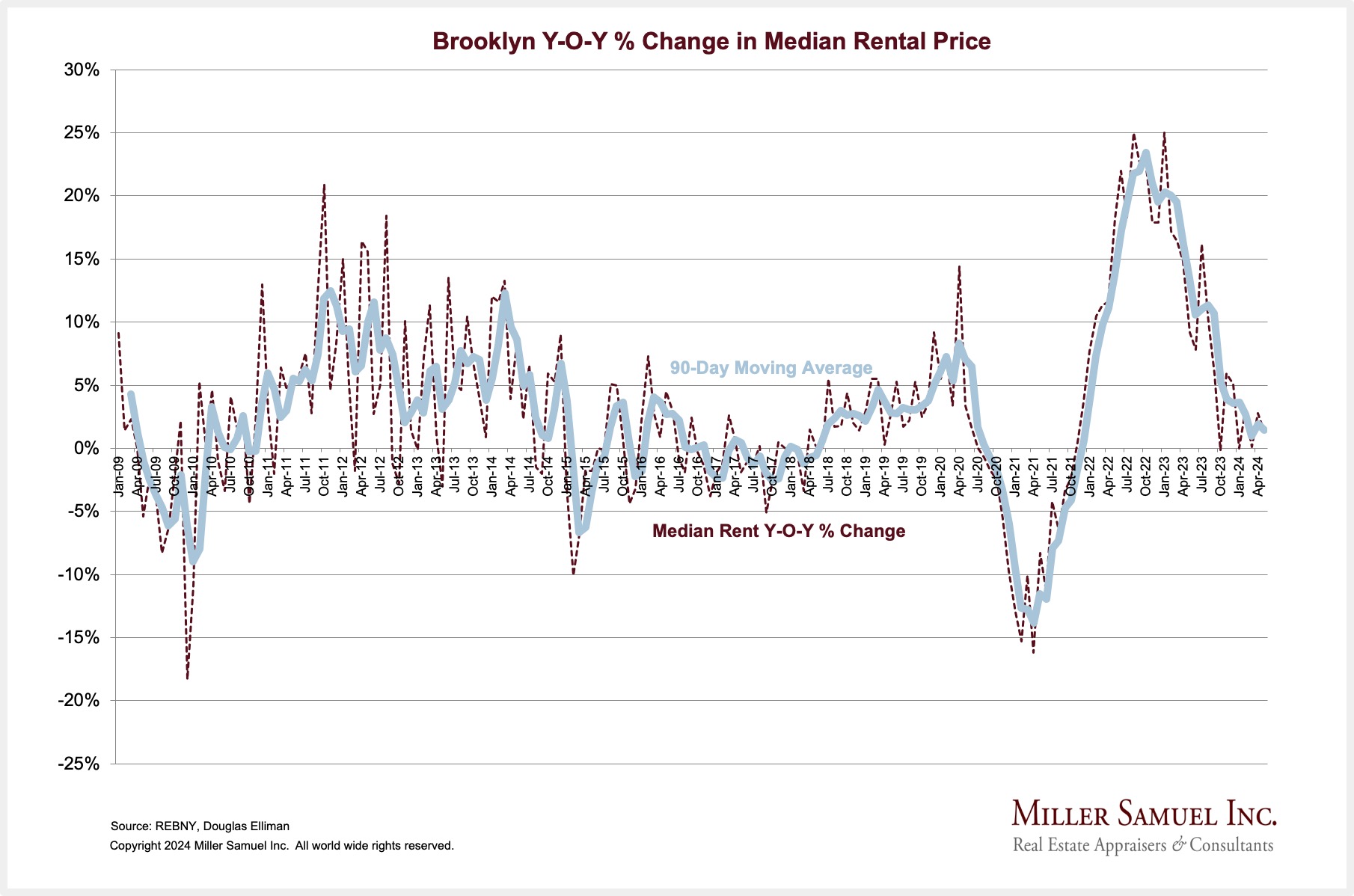

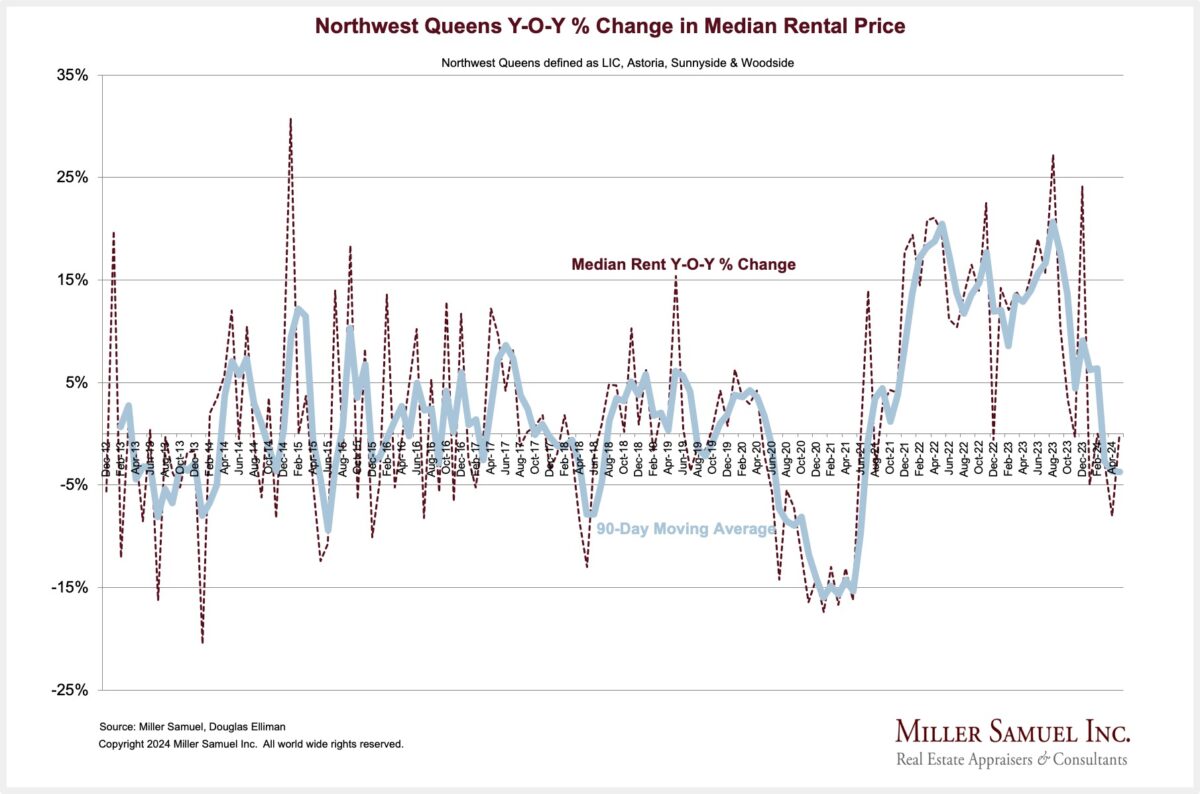

Brooklyn & NW Queens patterns have been similar

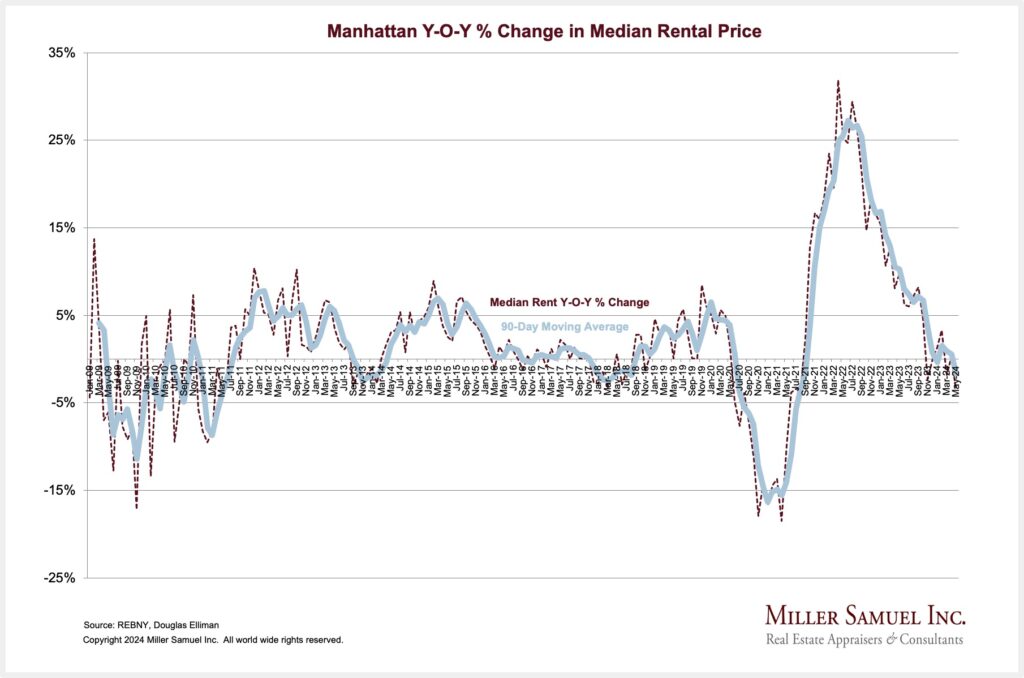

Mostly since the pandemic lockdown…

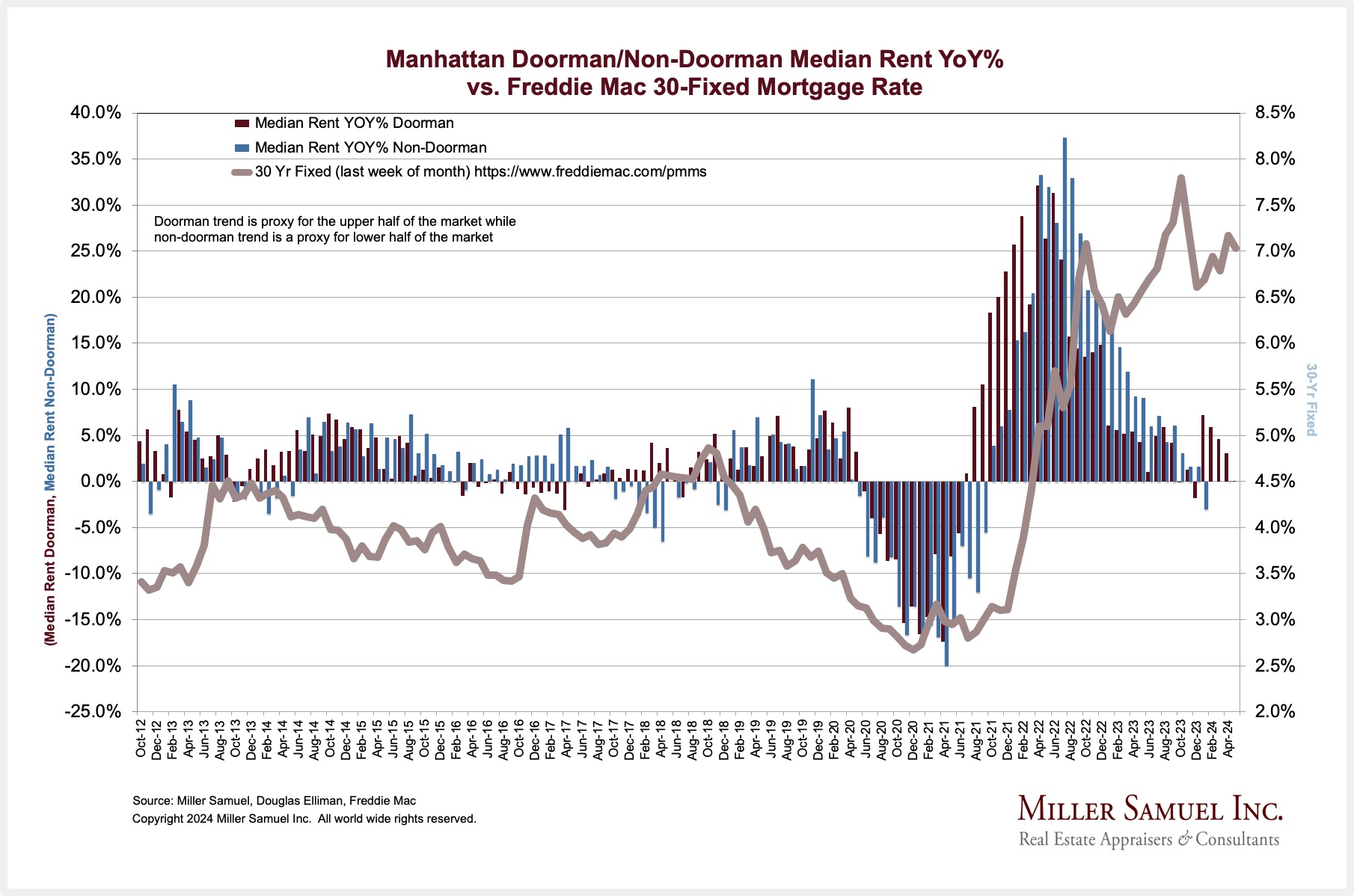

Mortgage rates and rents seem to relate

As the following chart clearly shows, as mortgage rates rise, rental prices rise. And strangely, rent direction seems to lead the direction of mortgage rates, not the other way around. I don’t believe there is causation and I suspect the reason is national data noise around interest rates, but these are the actual numbers.

In Manhattan, rental transactions in doorman buildings account for about half of total rental activity and serve as a proxy for the top half of the market by price. The other half of the rentals are in non-doorman buildings. When compared to the prevailing mortgage rate, both types of rents rise when mortgage rates rise and conversely, rents fall when mortgage rates fall. The doorman and non-doorman proxies for high-end and low-end are not mutually exclusive, having a ton of overlap, but these rental types split rental transactions literally in half.

Another nuance shown here is that when mortgage rates rise, the higher-priced rentals tend to respond earlier than lower-priced rentals. This pattern is made clear in the period from 2021 to 2023.

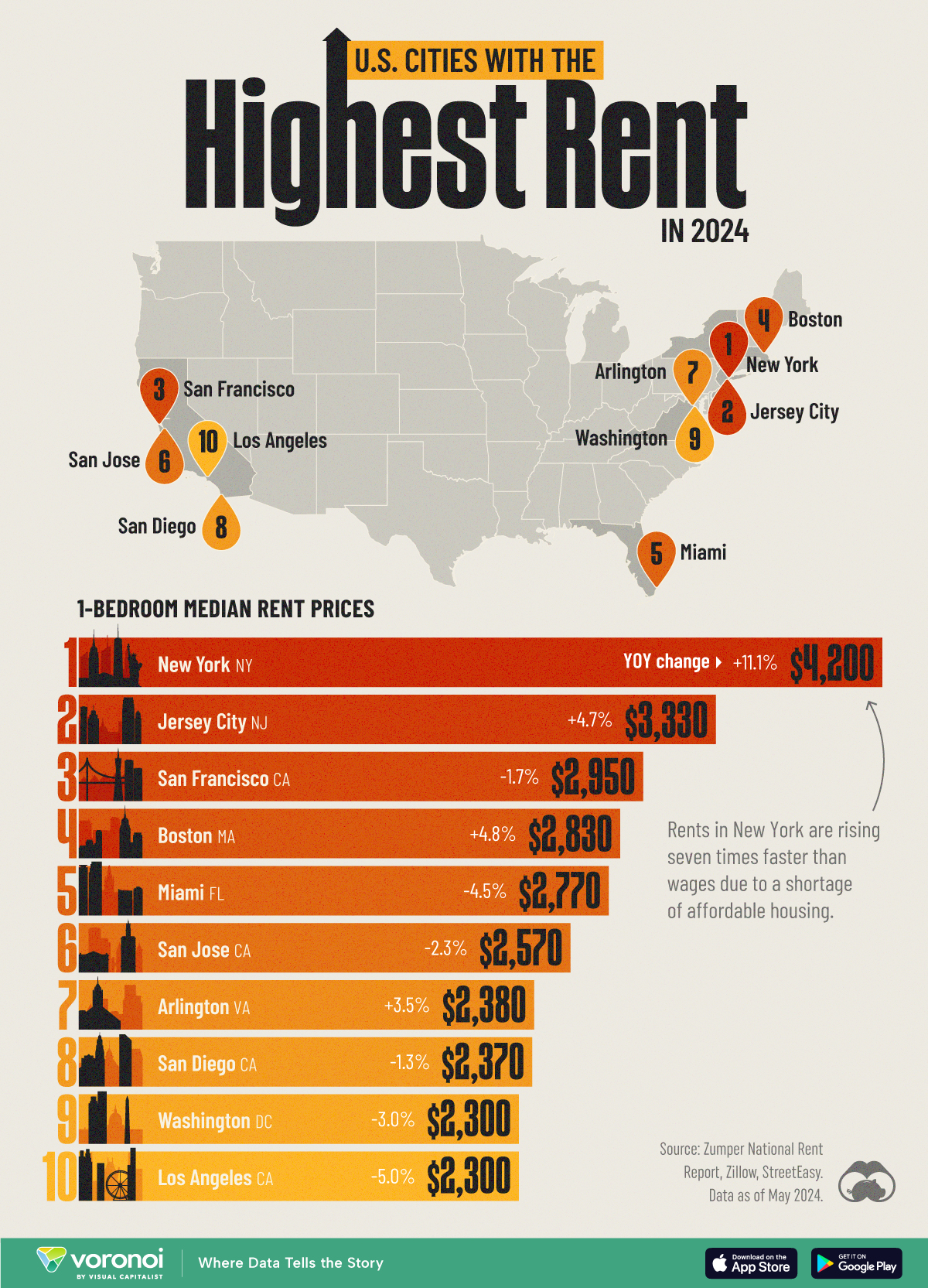

Number one in unaffordability

Zumper ranked New York number one in the U.S. with the highest rent. New York rents rose 7x faster than wages, hence the housing affordability crisis here. We’re splitting hairs when we say rent is rising or falling right now since it rose so fast it is considered unaffordable at current elevated levels.

To be clear, “New York, NY” on the following infographic means “Manhattan” but people outside New York think the reference is all of New York City. Jersey City, arguably part of the NYC metro area, gets the second spot, and San Francisco, a regular rival for the highest rent comes in third place.

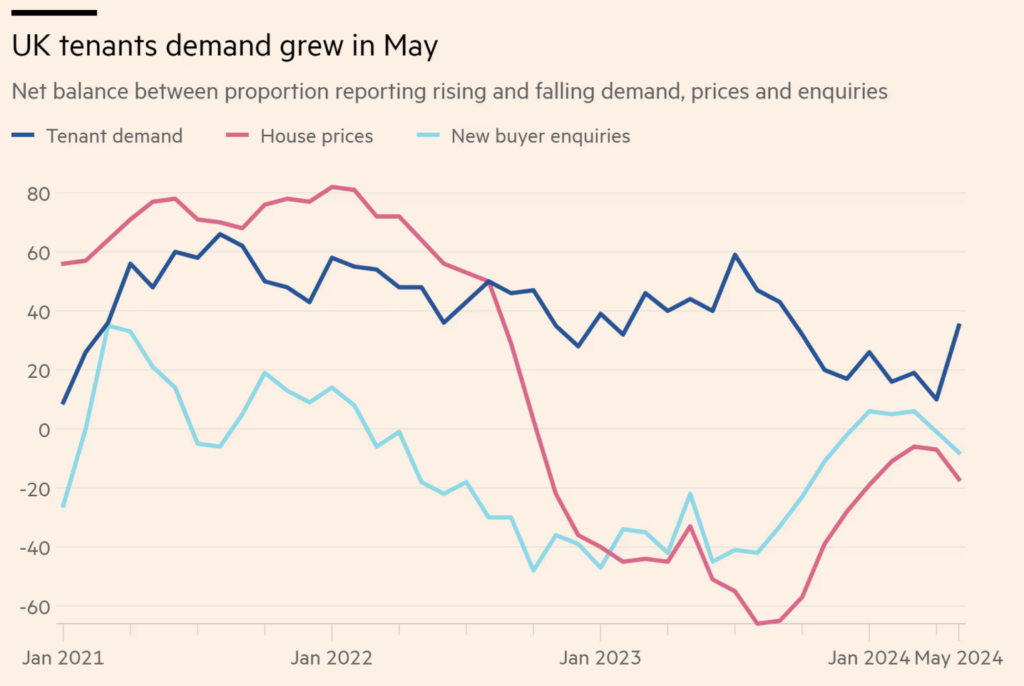

Rents started rising again in the UK

Oiling the rental market in North Dakota…

As an aside, there remains a lot of fracking going on as the U.S. exports more oil than any other country in the world. North Dakota is still undergoing an oil boom, especially in Williston which sits directly on the Bakken Formation, akin to the Permian Basin in Oklahoma (that accounts for nearly half of all crude oil production). I bring this up because this rural northwest North Dakota oil boom region has some of the highest residential rents in the US if you’re feeling sorry for your rent situation. At least you can buy strawberries at 3 am in New York.

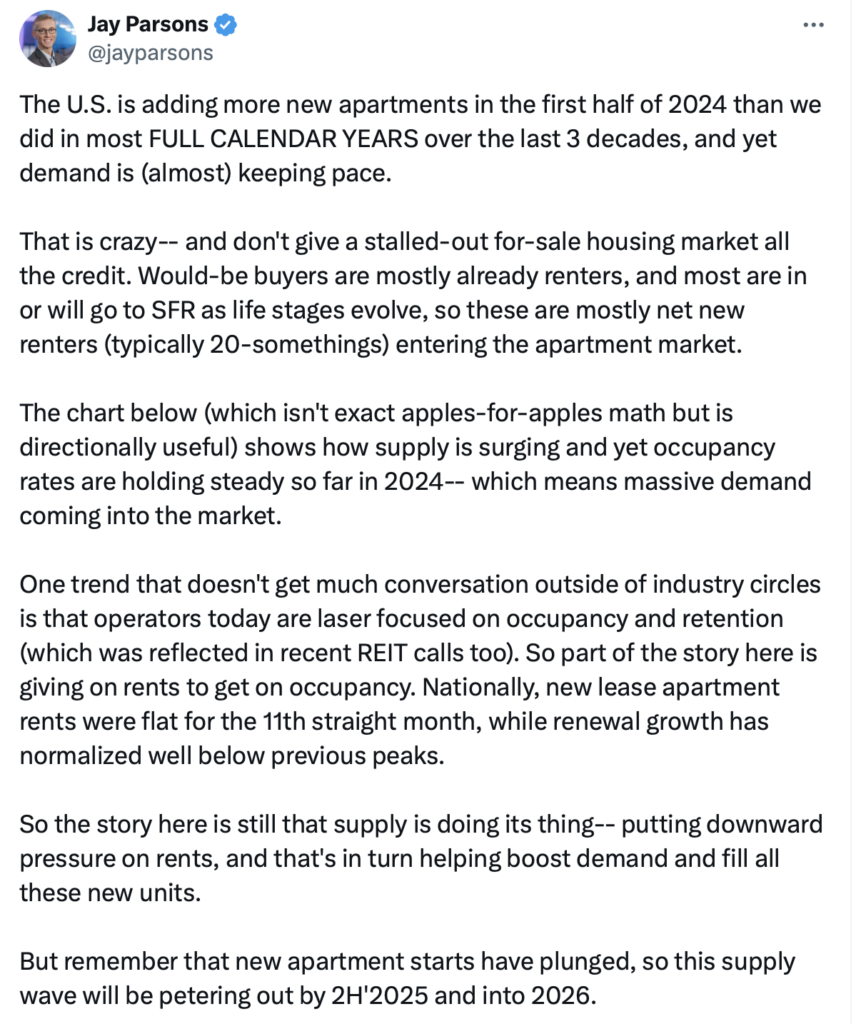

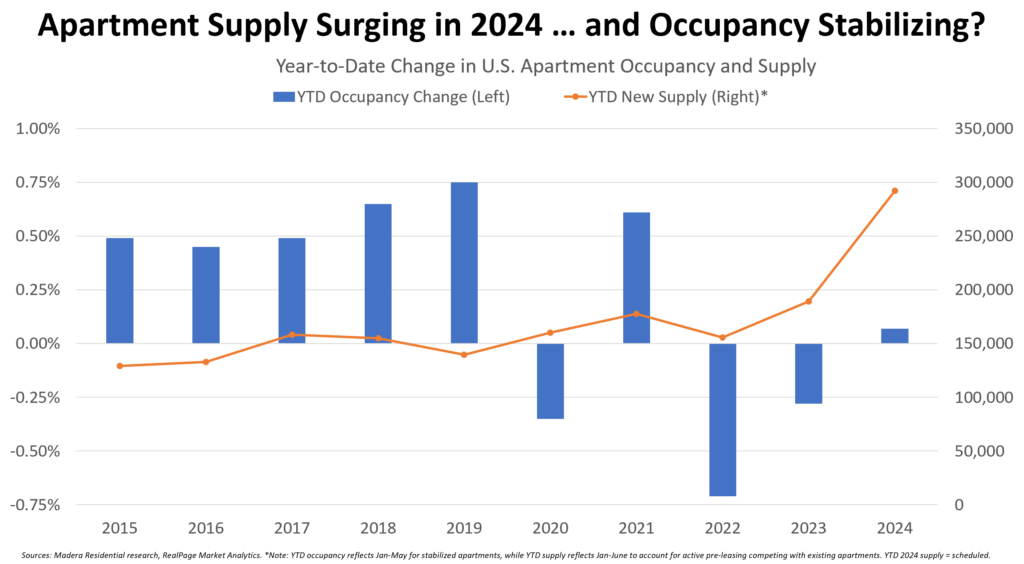

Oversupply meets excessive demand

Construction of multi-family (mostly rental) units is surging as occupancy is leveling off. Rental housing economist Jay Parsons is a good follow on Twitter. Here is what he says about the rental market. It’s not all about the stalled purchase market because of high rates. Significant demand from young millennials and gen-zs is keeping pricing elevated but stable as an offset to the overbuilding. Translation: Lots of supply coming in is being offset by increasing demand.

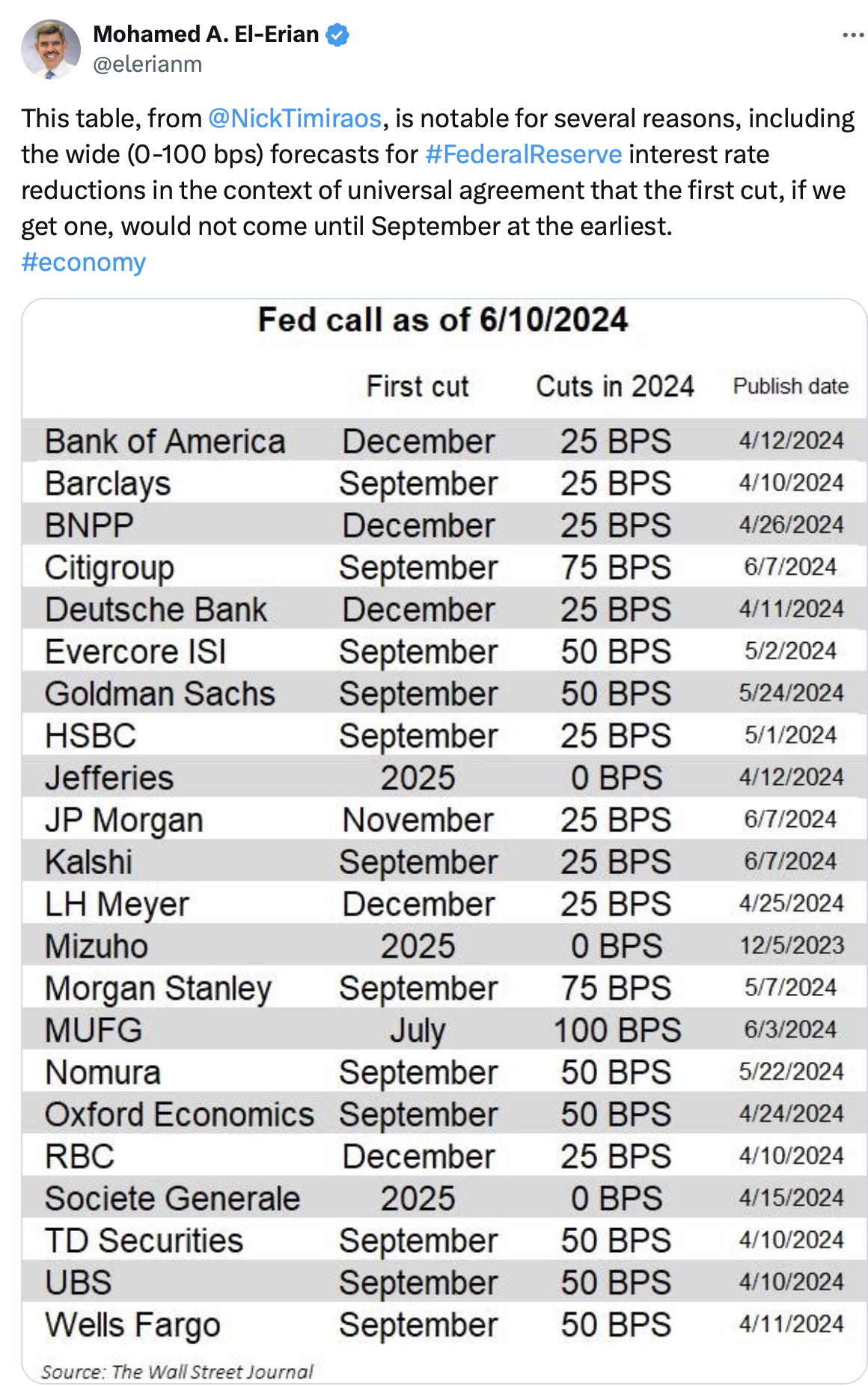

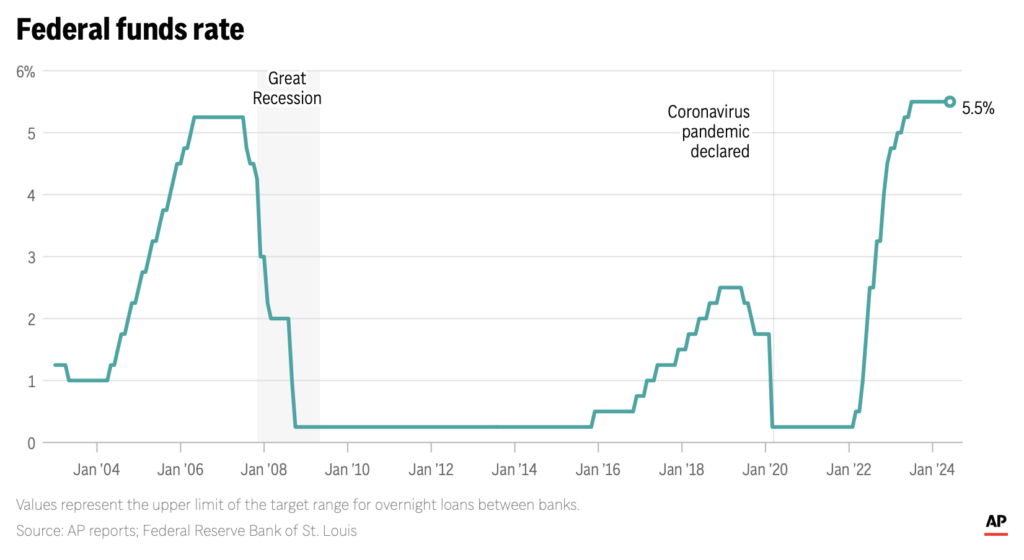

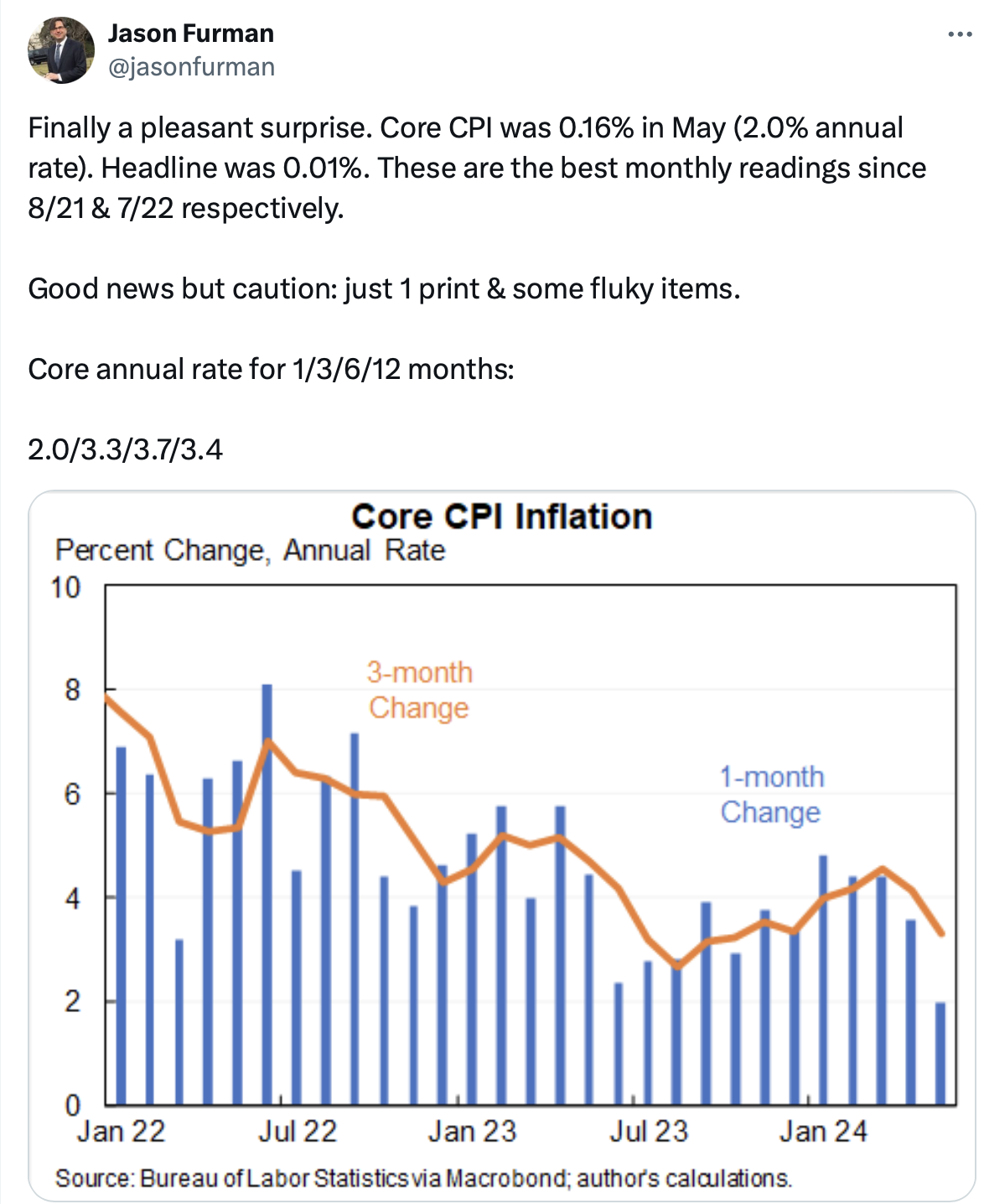

If lower rates soften rents: “When will there be a Fed rate cut?”

As the following table indicates, most economists seem to think that time will be September. Someone pointed out to me yesterday that these are probably the same economists who called for a rate cut last April and June. The economy still shows strength with 4% unemployment and higher wage gains than pre-pandemic so it’s hard to think about a rate cut at the moment.

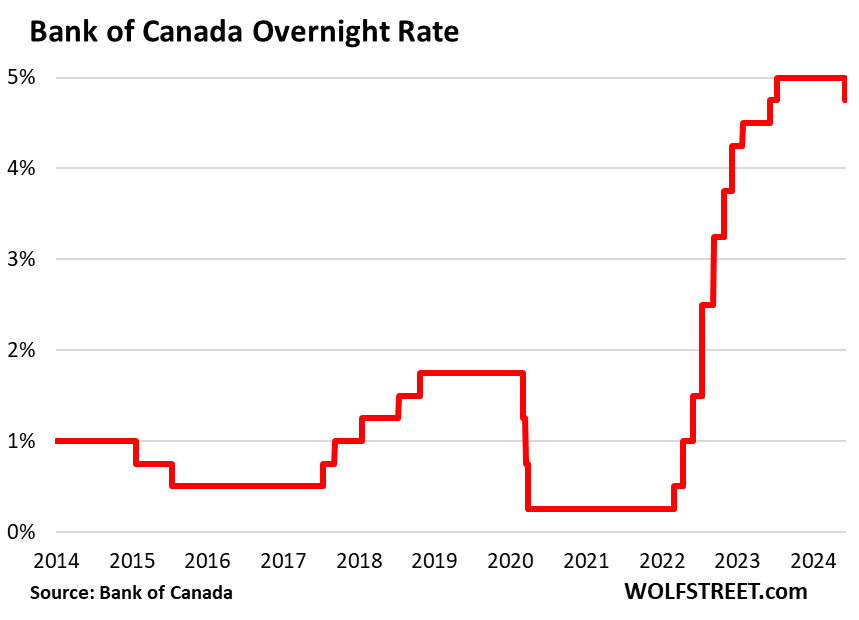

Yet, Canada just cut!

And considering how steep the Fed’s rate increase pattern has been, it’s no wonder the rate of inflation seems somewhat contained and we’re all chomping at the bit for a rate cut to get out of the current real estate “recession.”

And the inflation rate really is decidedly lower and we are seeing a growing number of retailers cut prices to increase demand, the definition of “greedflation.”

On Wednesday, the Fed Chair told us what we already knew. They changed their forecast from three cuts to one cut in 2024. Trained economists seem to think there will be a rate cut in September. Some economists even think there will be no rate cuts in 2024. Trained non-economists (me) think it’s going to happen in December. Either way, when a rate cut happens, 2.5 years of pent-up demand is going to cause a home sale surge nationwide, and listing inventory will be obliterated again keeping home prices elevated but softening rents a bit.

If you want something to worry about other than high interest rates, think about snakes in your drain.

Did you miss yesterday’s Housing Notes?

Housing Notes Reads

- Federal Reserve sees some progress on inflation but envisions just one rate cut this year [AP News]

- UK rental market faces ‘growing challenges’, survey finds [Financial Times]

- Bank of Canada Cuts by 25 basis points, to 4.75% as Economy and Inflation Slowed. QT Continues [Wolf Street]

- Brand new ten-story Tokyo condo to be demolished for blocking Mt. Fuji view [Boing Boing]

- Rents keep rising even as apartment inventory nears record highs [Crain's New York]

- Exclusive | Asking $120 Million: An Oceanfront Estate Near One of the Hamptons’ Most Expensive Streets [Wall Street Journal]

- Manhattan Apartment Rents Drop Even as Leasing Activity Picks Up [Bloomberg]

- Milei’s Way: The Bloomberg Open, Americas Edition [Bloomberg]

- Lacker Sees Zero Fed Rate Cuts in 2024 [Kathleen Hays – CBC Podcast]

- A North Dakota town is the most expensive place to rent an apartment in the United States [The Verge]

Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 5-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

Extra Curricular Reads

- Police apprehend 5-foot-long rogue snake in Upper Manhattan, NYPD says [Gothamist]

- X Is Making Likes Invisible to All but Original Posters [CNET]

- Joey Chestnut, Kobayashi To Compete In Hot Dog Eating Contest In September [TMZ]

- Duran Duran's Rio cover model identified 42 years later [Consequence]

- Joey Chestnut, Takeru Kobayashi to compete in Netflix competition [AP News]

- Joey Chestnut and Nathan’s Hot Dogs Part Ways Over Rival Brand Deal [The New York Times]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)