Despite the bad press EV and Hybrid cars have had recently with cold weather charging issues, the spike in interest rates that began in early 2022 didn’t seem to have the severe detrimental impact on car sales as it did on housing sales. With both, prices remained high despite the rates. Car sales took off and home sales slowed. Why?

With the chip shortage of 2022-2023, new car sale listing inventory collapsed as production stalled without the chips, so used car prices surged. Cars now account for 15% of global chip production (this is why I aspire to own late 1960s muscle cars). With an increase in chip production, new car sales are rising, taking some of the price pressure off of used cars even though they remain high.

UPDATE 4:23 pm ET One of our Housing Notes readers is a retired 40-year auto executive and he just sent me some feedback. He indicated that hybrids are much cheaper to build and sell than EVs and isn’t sure why the federal government is hyperfocused on EVs.

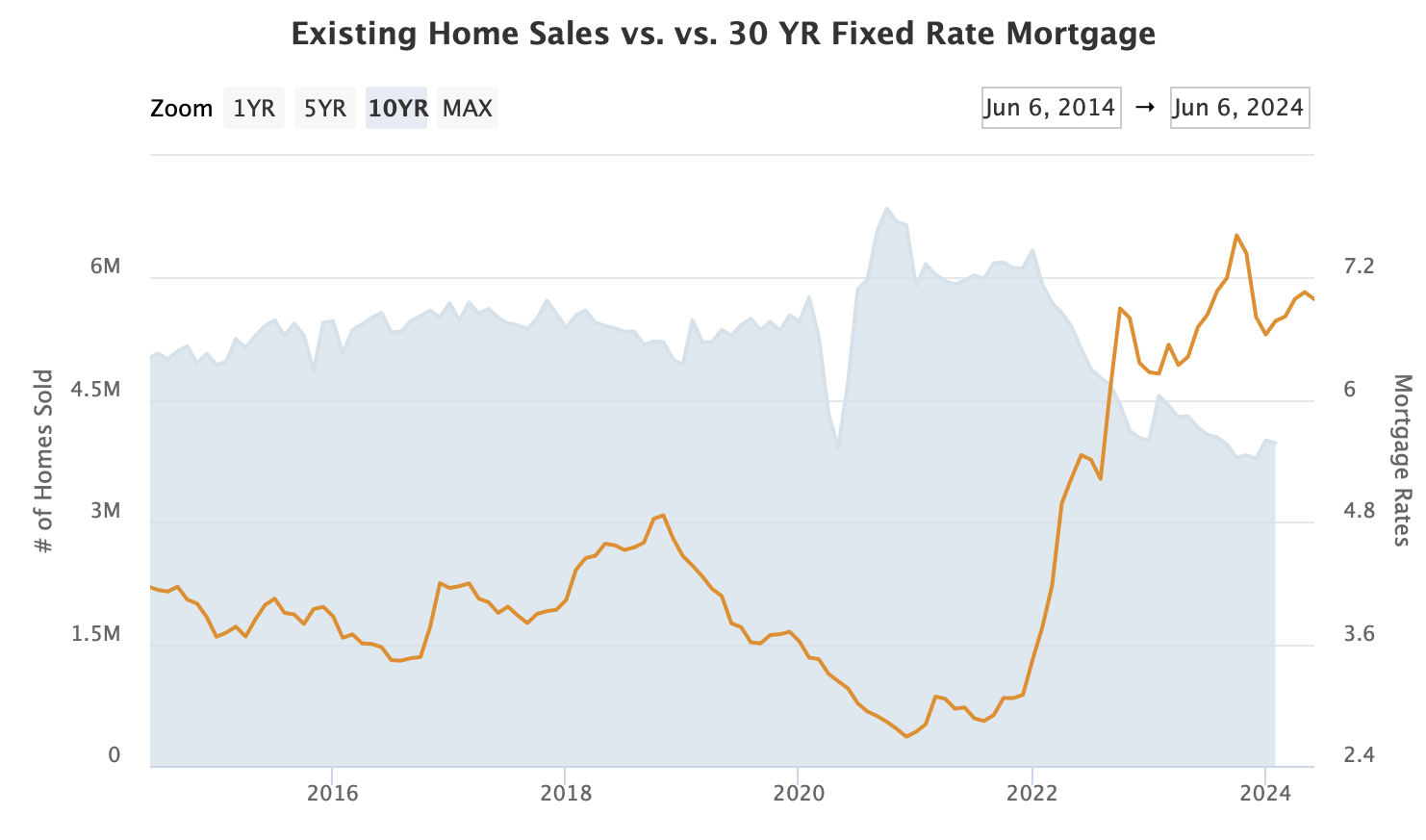

Existing home sales have fallen sharply for two reasons – listing inventory has been historically low (but that’s changing in some markets), and mortgage rates remain a lot higher than during the pandemic (you can thank the lock-in effect). New home sales have stabilized since the Fed pivot in 2022 rather than fall. New supply can be created more directly (not dependent on broad economic changes), and homebuilders have a greater ability than homeowners to buy down mortgage rates.

Takeaways

Home buying tends to surge when the economy weakens causing mortgage rates to fall. The drop in rates brings buyers into the market. It seems counterintuitive, but we can’t talk about the Fed cutting rates while unemployment remains at 4% – plus they tend to wait too long to make a call.

Car buying tends to do better with a strong job market (which keeps rates high) and high wages. We continue to see high rates because of low unemployment, the latter of which helps the car market.

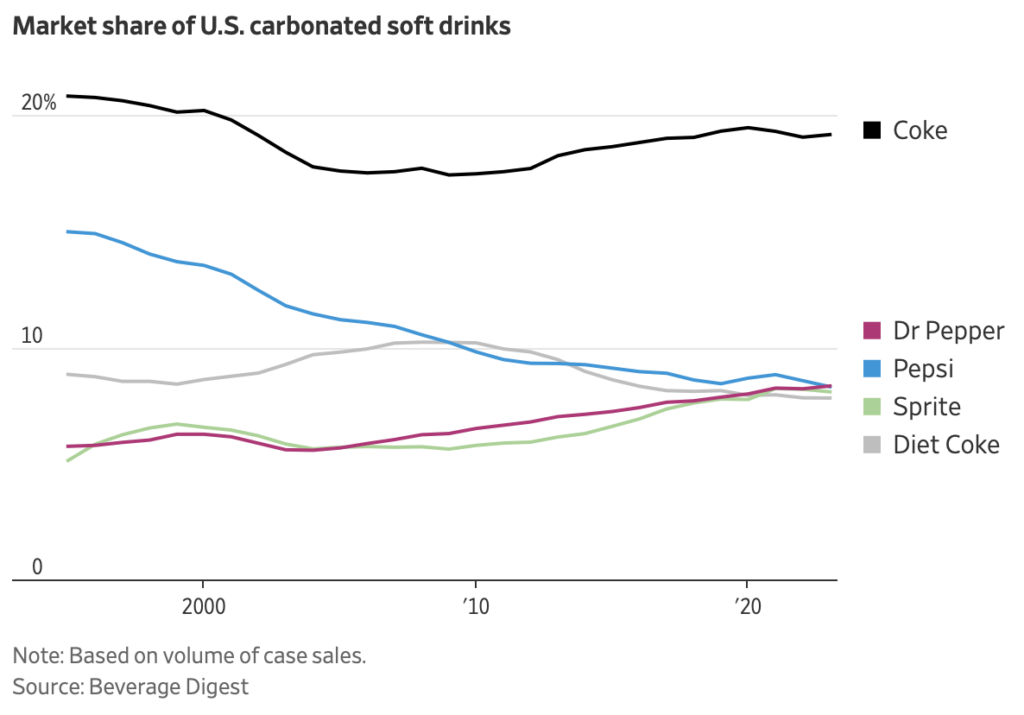

Of course, while you’re considering the car sales versus home sale economics, you’re probably having a drink, and it’s probably Dr. Pepper. It has to be because Dr. Pepper now ties Pepsi as the number 2 consumed soda.

Since Diet Coke and Sprite are owned by the same company that owns Coke, it is important to classify “tied for second” as a very distant “second” for Dr. Pepper.

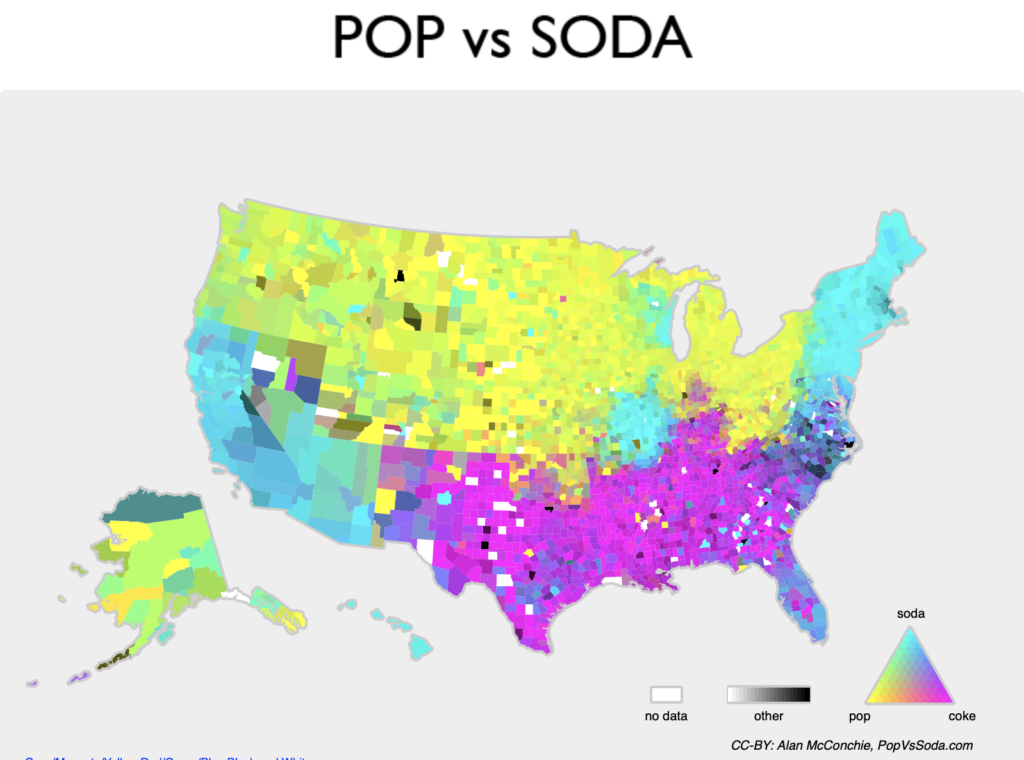

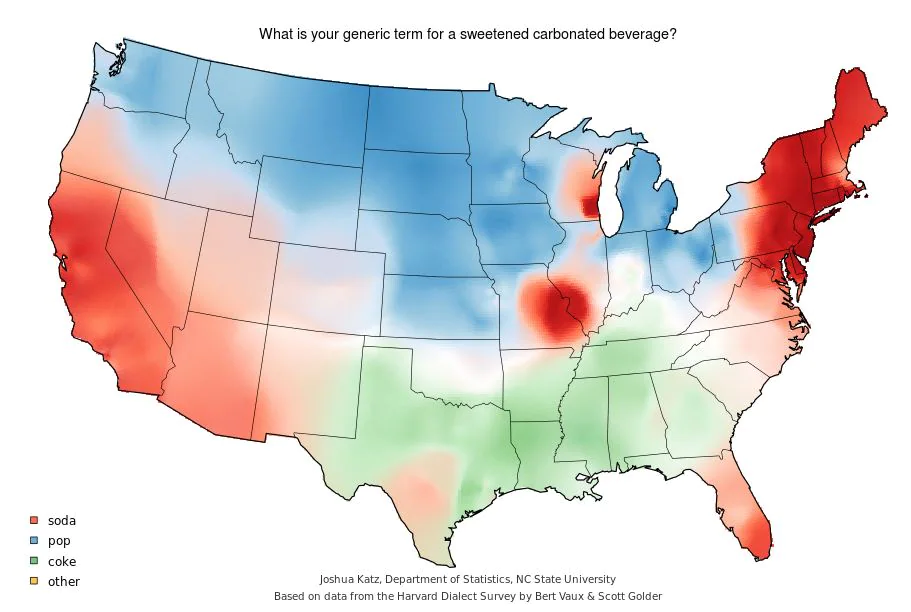

But more importantly, what do we call these beverages? It depends on where you live. Growing up in the northeast, it’s always been “soda” but my wife’s family is from Michigan where it’s known as “pop.” I just can’t.

Analyzing this terminology has long been a thing and the same patterns seem to remain in place.

Did you miss Friday’s Housing Notes?

This Is A Whole New Thing – Housing Notes Daily

Well, I’ve been writing this Housing Notes newsletter since March 2015 (more than 9 years as a weekly exercise) and at last count were nearly 500 weekly iterations, evolving into a Friday 2 pm launch date no matter where I was in the world, whether or not I was on vacation, and what was going on in my personal life. It was such a consistent routine that many subscribers told me it marked the beginning of their weekend. But what is going to be so new about Housing Notes Daily?

Less is more. The type of content will largely remain the same but in a shorter format and the delivery will be daily instead of weekly. Starting immediately, Housing Notes will be released 5 weekdays each week at that same 2 pm Eastern time moment. My sidebar passion project Appraiserville is being moved to the Beehiiv platform soon and I plan on releasing it weekly while linking from here temporarily. More on that soon

Housing Notes Reads

- Homebuilders are still buying down rates to move houses [HousingWire]

- High-end condos, co-ops bright spots for Manhattan in May [Inman]

- After backlash, Bing is removing MLS listings [Real Estate News]

- Homes for Sale Are Piling Up, Just Not Where the Buyers Are [Bloomberg]

Market Reports

- Elliman Report: Florida New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 5-2024 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 4-2024 [Miller Samuel]

- Elliman Report: California New Signed Contracts 4-2024 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 4-2024 [Miller Samuel]

Extra Curricular Reads

- The Soda vs. Pop Map [NY Times]

- Coke, soda and pop: Three words that divide a nation [Washington Post]

- The Pop vs. Soda Page

- Names for soft drinks in the United States [Wikipedia]

- Dr Pepper Ties Pepsi as America’s No. 2 Soda [Wall Street Journal]

- That Much-Despised Apple Ad Could Be More Disturbing Than It Looks [New York Times]

![[Podcast] Episode 4: What It Means With Jonathan Miller](https://millersamuel.com/files/2025/04/WhatItMeans.jpeg)