- Sales In 2024 Of $100 Million Homes Expected To Double The 2023 Total

- The Superluxury Market As Nothing To Do With The Local Market

- Aspirational Pricing Is All About Branding, Not About Selling A Home

After a couple of horrifically bad behavior real estate stories here on Housing Notes, consider today a palate cleanser. It’s a relief to share something so fantabulous when compared to everyday living, that it is hard to take seriously, yet it kind of is.

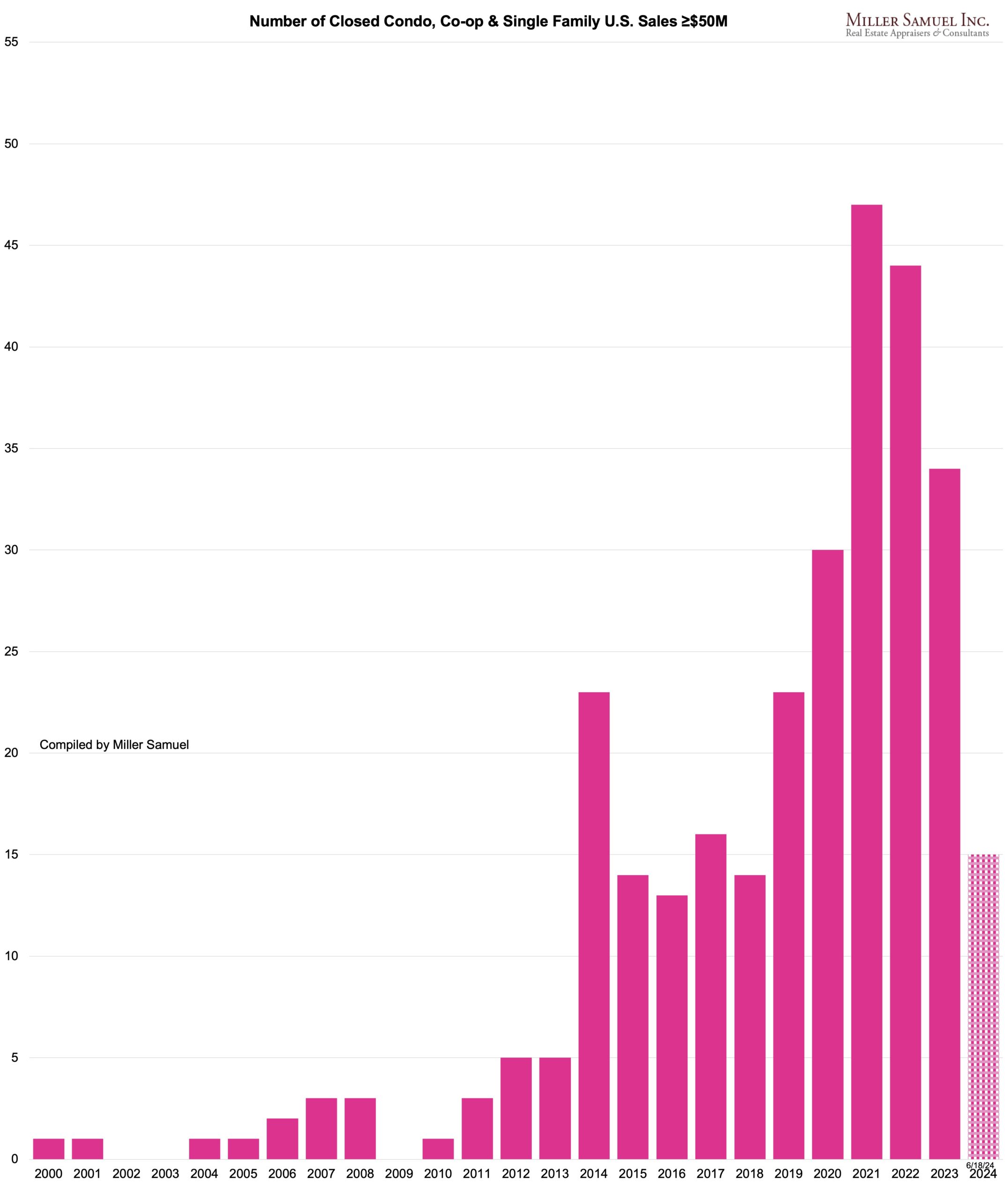

About a decade ago I began tracking U.S. home sales at or above the $50 million price threshold as a hobby (yes, I’m quite dull and boring). I got the idea to maintain the list about fifteenish years ago. The effort has become a weekly work-in-progress as this market gets most of the real estate eyeballs but literally has nothing to do with housing for mere mortals.

Sales in the superluxury housing market for 2024 are on pace to equal or even exceed 2023 levels (the third most in history) despite the spike in mortgage rates. Buyers of these properties are more dependent on the financial markets than interest rates themselves. As I’ve mentioned here before, fed policy ultimately influences mortgage rates but it also influences the financial markets. It is incorrect to suggest that the high-end real estate market doesn’t care about interest rates.

Where the idea to cover the super luxury market came from

- I was observing a never-ending series of stories on record-high asking prices that led with statements like this:

- This home is the highest-asking price in California

- This listing is the highest-priced home in the U.S.

- This condo is the highest-asking price in NYC history

- A great reporter at Forbes would regularly call me about the ranking status of a new listing. I also began to see lots of headlines in the Wall Street Journal (their Mansion Global property) circa 2015.

- A California heiress listed one of her homes for more than $30 million and filmed a chase-themed professional-grade movie within it to promote it – then placed it on an iPad in clever packaging. She sent a videographer to film me in my New York office and I blogged about it. They let me keep the iPad – back when they were a limited commodity).

My simple observation was that no one seemed to be tracking these high-end sales after they closed. Were they successfully sold? Often not. Many of the listings became prestige statements of the owners, rather than legitimate attempts to sell.

Jargonwatch Aspirational Pricing

I was being interviewed on Bloomberg Television in early 2016 and I used the phrase “aspirational pricing” to refer to the seemingly new trend of luxury homeowners wildly overpricing their listings. It caught on and became part of the luxury real estate nomenclature.

I was interviewed about this in 2018 by Bloomberg when a $250 million home sold for $94 million. The market didn’t crater. It was never worth $250 million.

“One of the reasons why this is more severe, on a percentage basis, at the high end is these properties are very unique, and therefore very hard to price,” Miller says. And even though the initial list prices are often way off the mark, the properties still can set records when they sell. Each of these super-high-end sales “shows you how extreme the aspirational pricing was to begin with.”

Bloomberg

My collection of data is based on our appraisal inspections within markets we cover (mainly Manhattan/Hamptons), sales within markets we appraise, and sales where we perform market studies or news articles. It takes a little while to suss out the details for each sale.

One of the early examples of aspirational pricing was the first U.S. listing for $100 million back in 2012. It was the penthouse condo in a generic mid-80s Midtown Manhattan highrise that probably wasn’t worth anywhere near that price – perhaps only 20% to 35% of that amount at the time. But that wasn’t the point. As a developer, the seller saw public relations value in his name being plastered across the media.

One of the first real estate stories I read when I moved to New York in the mid-1980s was about Ian Bruce Eichner, the developer who built CitySpire. He characterized the development of tall buildings as weenie-waving for New York Magazine. A few years ago I got to meet him and we talked about that story – it was a hoot.

One of the more intense bastions of aspirational pricing I observed was located in The Hamptons on the eastern end of Long Island as well as the Malibu/Los Angeles area. Here’s how it worked. A homeowner buys a $5 million home and then guts and renovates it for another $5 million. They list it for $40 million but never sells. A neighbor lists their similar property for about $40 million and soon all properties in the immediate area go on the market for a similar price with the justification that their neighbors have a similar property so they set the market. Soon Page Six or other gossip columns append their bold-faced name with “who has a $40 million Hamptons home”. Yet none of these homes ever sell.

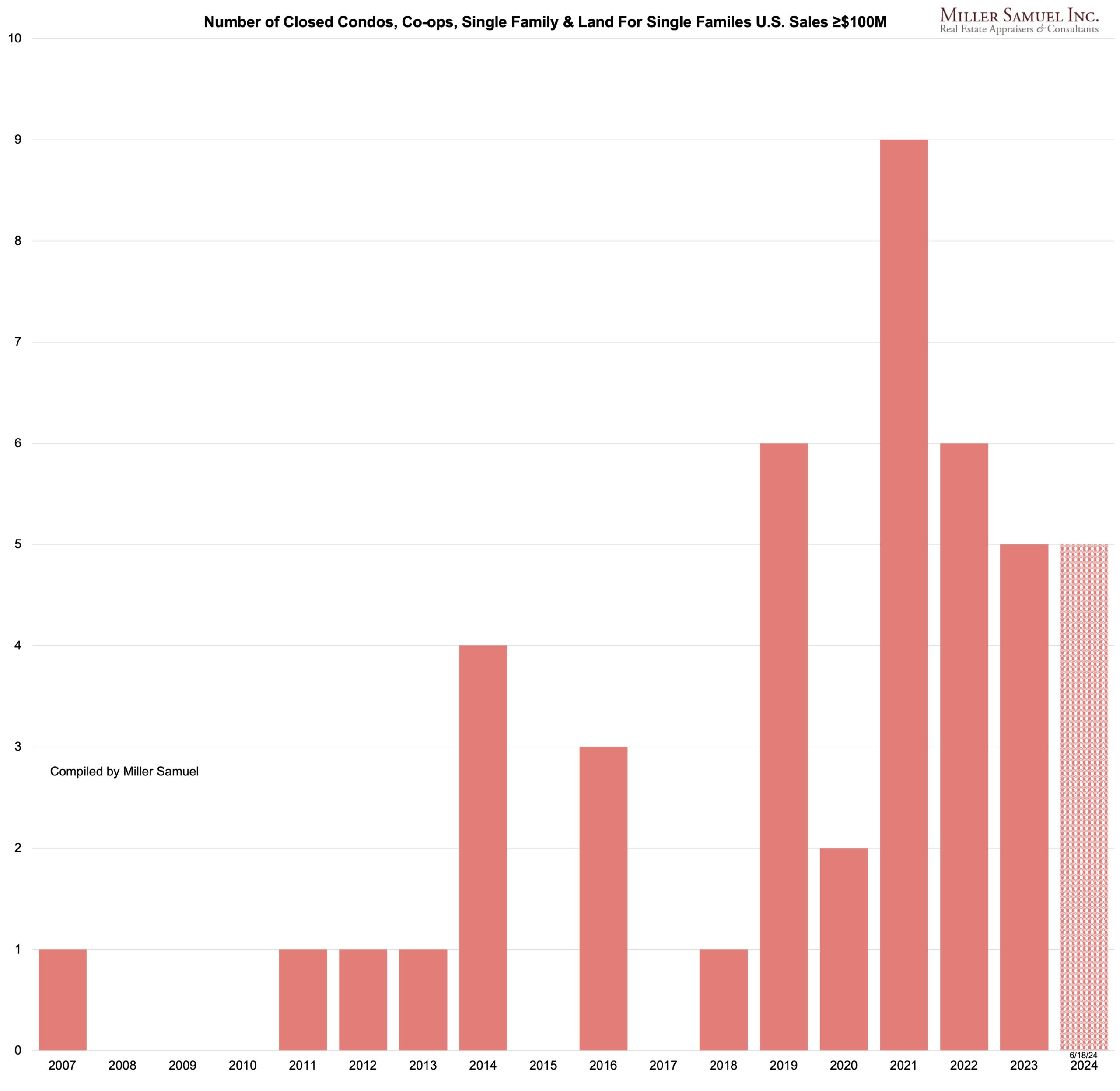

Sales in 2024 of $100 million or higher homes are expected to double the 2023 total and perhaps set a new record.

Super luxury should not be commingled with the overall market

My friend and former big deal at the essential real estate industry rag The Real Deal for the past decade, Hiten Samtani was interviewed on Bloomberg’s Odd Lots podcast (below). It’s an essential conversation on understanding the “parallel universe” of HNWI behavior. While you’re at it, please check out Hiten’s latest effort, The Promote – your insider guide to CRE. His extensive background in journalism and media content makes this newsletter a pleasure to read while keeping you informed.

I reconcile this super luxury activity with the assumption that their lives must be miserable compared to mine.

![Brooklyn Rental Listing Inventory by Month [Average from 2010]](https://millersamuel.com/files/2024/07/Aug24BKLYNrent-invBYmo-1200x786.jpg)